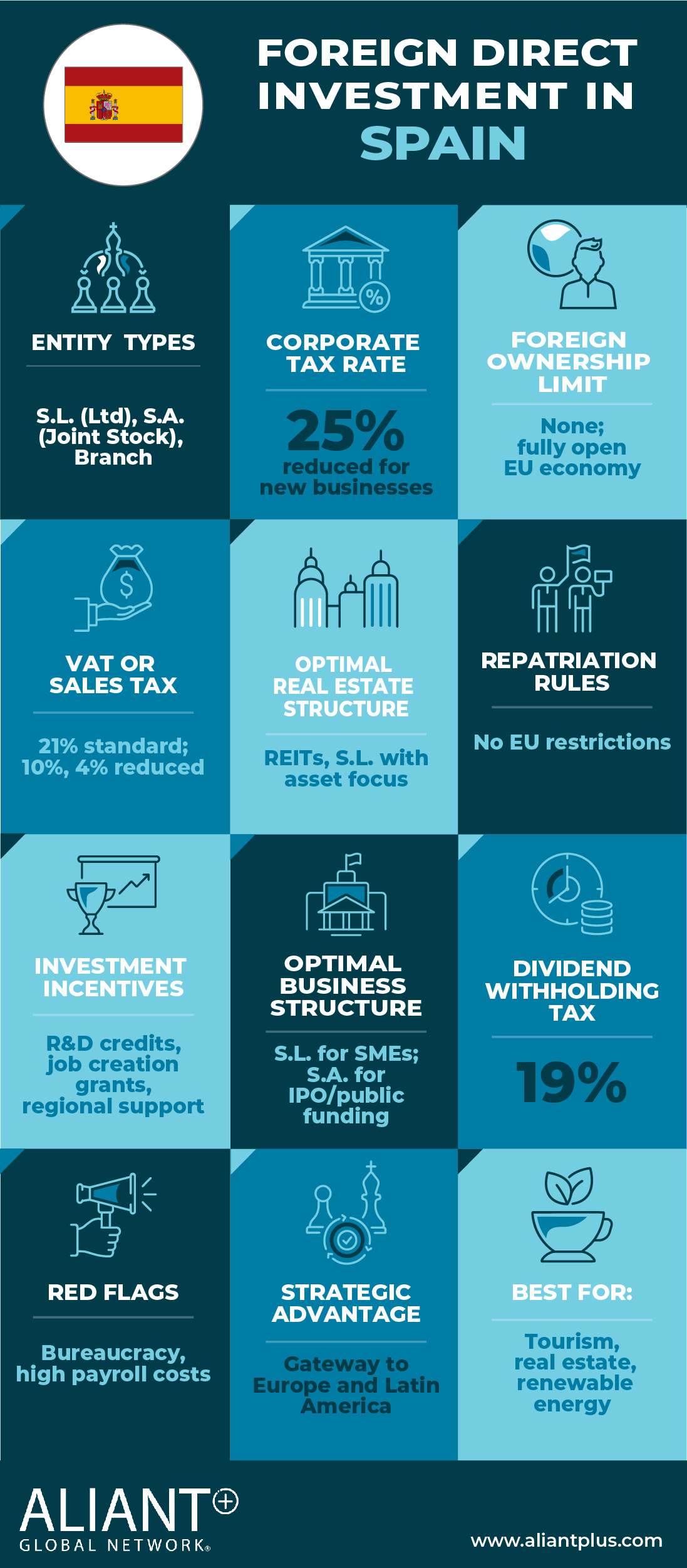

Chapter 16 – Foreign Direct Investment in Spain

I. Country Snapshot

II. Introduction

Spain is one of the most dynamic and attractive economies in Europe, offering significant opportunities for foreign investors. With its strong industrial base, extensive real estate market, and geostrategic position as a gateway to European, North African, Middle Eastern, and Latin American markets, Spain continues to attract international capital.

The country provides multiple investment structures, ensuring flexibility for foreign businesses. Investors should carefully assess legal structures, taxation, and regulatory requirements to optimize their business strategy. This document provides an overview of the key aspects of foreign direct investment in Spain, including business formation, real estate ownership, and tax considerations.

III. Ownership Structures

Foreign investors can establish a business presence in Spain through various legal entities, each offering different levels of liability protection, investment flexibility, and tax implications.

Limited Liability Company (S.L.) and Public Limited Company (S.A.)

A limited liability company (Sociedad Limitada – S.L.) is the most commonly used business structure in Spain, particularly for small and medium sized enterprises. It provides shareholders with limited liability, meaning they are only responsible for their capital contributions. The minimum capital stock required to establish an S.L. is €3,000.

A public limited company (Sociedad Anónima – S.A.) is suitable for larger businesses or those planning to raise capital publicly. It requires a minimum share capital of €60,000, and shares can be traded on the stock exchange. Both S.L. and S.A. structures require a public deed signed before a notary and registration in the Commercial Register.

Branch (Sucursal)

A branch is a permanent establishment that operates as an extension of the parent company, enjoying a certain degree of management independence. Unlike an S.L. or S.A., a branch does not have a separate legal personality, meaning that the parent company is fully liable for its obligations.

A branch must be registered with the Commercial Register, and while no minimum capital stock is required, it must maintain separate accounting records for its activities. A resident director with power of attorney must be appointed to manage the branch, and a resident tax representative is required to ensure compliance with Spanish tax regulations.

Permanent Establishment

A permanent establishment is a fixed place of business in Spain that is used to carry out commercial activities. It may take the form of an office, factory, warehouse, retail outlet, or construction project lasting more than six months. The legal liability of a permanent establishment extends to its parent company, and it is required to comply with Spanish tax laws, including corporate income tax.

This structure is commonly used for businesses that intend to operate in Spain without setting up a separate legal entity. While a permanent establishment must maintain accounting records, it is not required to register with the Commercial Register.

IV. Suggested Structures for Real Estate and Business Investments

Real Estate Investments

- Optimal Structure: A limited liability company (S.L.) holding the real estate

- Why: Holding real estate through an S.L. provides limited liability protection and allows for tax optimization upon the sale of property. It also simplifies ownership transfers and estate planning.

- Bonus: Certain tax benefits may apply depending on the nature of the property transaction. The Spanish tax system differentiates between Value Added Tax (VAT) for new properties and Property Transfer Tax (ITP) for second hand properties. Foreign investors should consider structuring their real estate acquisitions to minimize tax

Business Investments

- Optimal Structure: A limited liability company (S.L.) for small and medium sized businesses or a public limited company (S.A.) for large corporations.

- Why: An S.L. provides flexibility, limited liability, and lower regulatory requirements, making it ideal for privately held businesses. An S.A. is necessary for companies seeking external financing through capital markets.

- Bonus: Foreign investors looking to optimize their tax position may benefit from structuring their investments through a holding company, particularly if taking advantage of Spain’s double taxation treaties and EU tax directives.

V. Simplified Tax Overview

Spain’s corporate tax system includes multiple layers, with different rates and obligations depending on the type of business entity and sector.

- Corporate income tax is 25% for most

- Withholding tax on dividends is 19%, unless a double taxation treaty

- Value added tax (VAT) is levied at 10% for real estate transactions and 21% for general goods and services.

- Real estate transfer tax (ITP) ranges from 8% to 10%, depending on the

- Financial transactions tax applies at 2% to acquisitions of shares in listed Spanish companies with a market capitalization exceeding €1 billion.

Investment Incentives

Spain offers various incentives to encourage foreign investment, including:

- R&D tax credits for companies engaged in technological

- Regional grants and subsidies for businesses setting up operations in designated economic zones.

- Tax benefits for reinvestment of profits in qualifying business

VI. Key Investment Considerations

Foreign investors should carefully assess regulatory and compliance requirements before entering the Spanish market.

- Sector specific regulations apply to industries such as banking, telecommunications, and defense, where foreign ownership may be restricted or require government approval.

- Real estate acquisition by non EU investors may be subject to additional regulatory reviews, particularly if the property is located in a strategic area.

- Corporate governance and reporting requirements vary depending on the entity type, with public companies facing more stringent compliance obligations.

Spain’s tax authorities closely monitor cross border transactions, making it essential for foreign investors to ensure compliance with transfer pricing regulations and substance requirements for tax purposes.

VII. Conclusion

Taken together, Spain offers attractive openings for well‑structured investments when investors align with local compliance requirements and leverage available incentives. With prudent structuring, effective tax rates and regulatory friction can be kept competitive, allowing foreign entrants to capture long‑term growth.

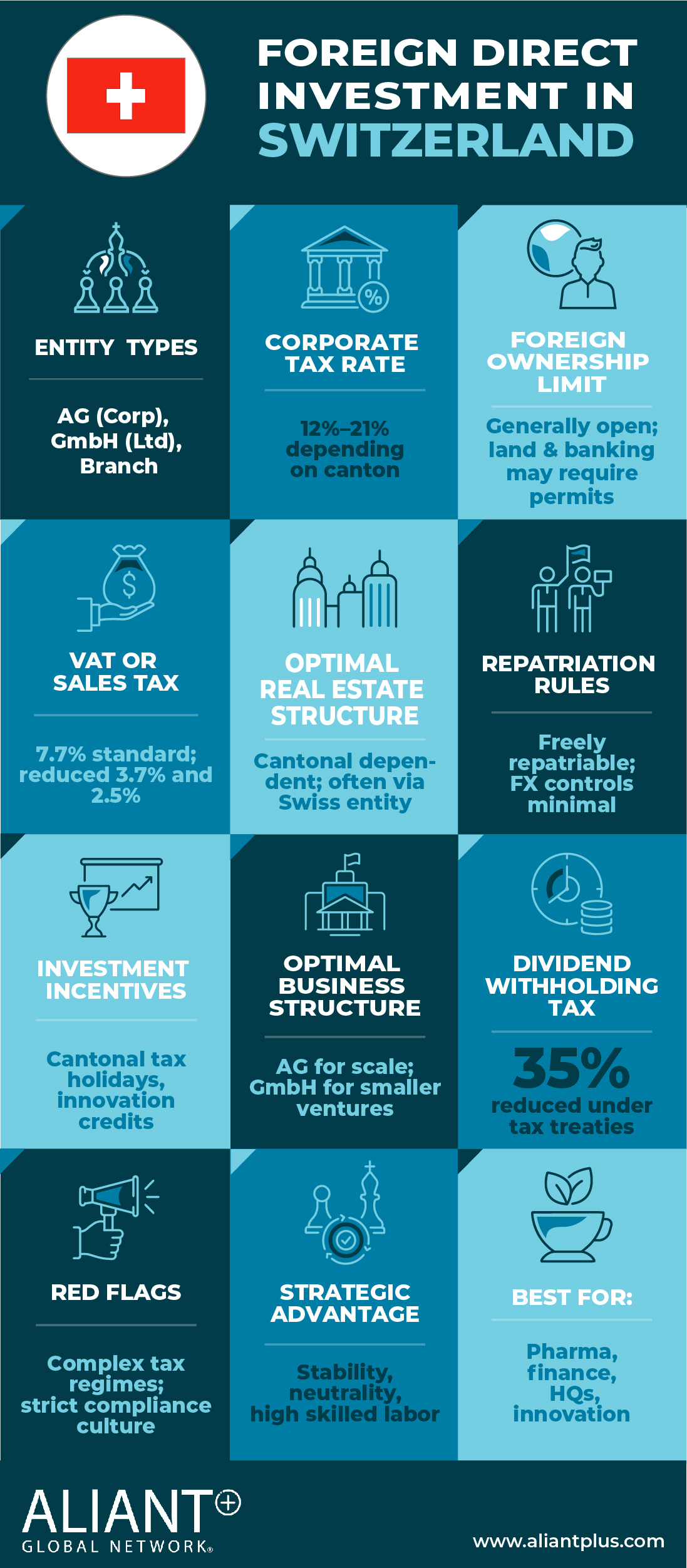

Chapter 17 – Foreign Direct Investment in Switzerland

I. Country Snapshot

II.Introduction

Switzerland is one of the most attractive destinations for foreign direct investment (FDI), offering a stable political environment, a strong economy, and business friendly policies. The country is known for its innovation, advanced financial sector, and commitment to intellectual property protection, making it a preferred location for multinational corporations and international investors.

Switzerland imposes minimal restrictions on foreign ownership, ensuring that investors benefit from legal protections and ease of capital movement. However, like any investment destination, it presents both opportunities and challenges that foreign investors should consider. Key factors include selecting the appropriate corporate structure, understanding regulatory requirements, and managing operational costs.

This document provides an overview of Switzerland’s legal and tax framework for foreign investors, along with insights into optimal investment structures for business and real estate holdings.

III. Ownership Structures

Switzerland provides several options for foreign investors to structure their investments, each offering distinct benefits in terms of liability protection, tax efficiency, and operational flexibility.

Direct Investment

Foreign investors can directly acquire Swiss companies, real estate, or other assets without significant restrictions. Switzerland does not impose currency controls and offers strong investor protections under its legal system. However, certain sectors, such as banking and real estate, may require additional approvals or compliance with local regulations.

Limited Liability Company (GmbH)

The limited liability company (Gesellschaft mit beschränkter Haftung – GmbH) is the most common corporate structure for small and medium sized enterprises. It requires a minimum share capital of CHF 20,000 and provides limited liability protection for shareholders. A GmbH must have at least one Swiss resident director for regulatory compliance. It is generally more cost effective and flexible than a joint stock company (AG), making it suitable for private businesses.

Joint – Stock Company (AG)

For larger businesses and multinational investors, the joint stock company (Aktiengesellschaft – AG) is the preferred structure. It requires a minimum share capital of CHF 100,000, with at least CHF 50,000 paid in at incorporation. Shares can be privately held or publicly traded, and the structure provides strong liability protection and international credibility. At least one board member must be a Swiss resident for compliance purposes.

Branch Office

Foreign companies can establish a Swiss branch rather than forming a separate legal entity. The parent company remains fully liable for the branch’s obligations. A branch must be registered in the Swiss Commercial Register and is subject to Swiss corporate taxation. However, it does not require a separate share capital, making it a practical solution for companies testing the Swiss market before full incorporation.

Representative Office

For companies exploring the Swiss market, a representative office can be set up for market research and liaison activities. It cannot engage in direct commercial activities and is not subject to Swiss taxation if it does not generate revenue. Many foreign corporations use representative offices before making long term investment commitment

IV. Suggested Structures for Real Estate and Business Investments

Real Estate Investments

- Optimal Structure: Holding real estate through an AG or

- Why: Holding real estate through a Swiss corporate entity provides liability protection for investors, ensures compliance with Swiss real estate laws, and allows for efficient management of rental income and capital gains.

- Bonus: Certain cantons impose restrictions on foreign property ownership, making it advisable to invest through a Swiss entity rather than as an individual. Investors should conduct due diligence to understand cantonal regulations before purchasing real

Business Investments

- Optimal Structure: An AG for large investments, a GmbH for small and medium sized

- Why: An AG offers credibility and access to international markets, making it the preferred structure for larger enterprises. A GmbH is simpler and more cost effective for privately held companies while still providing limited liability protection. Both structures allow for full foreign ownership and tax optimization strategies.

- Bonus: Investors looking for additional tax benefits may consider structuring their holdings through a Swiss holding company, which can provide preferential tax treatment in certain cantons.

V. Simplified Tax Overview

Switzerland offers a competitive tax environment, but tax rates vary by canton and municipality. Key tax considerations include:

- Corporate income tax rates range between 12% and 25%, depending on the location of the business.

- Withholding tax on dividends is generally 35%, though reductions may apply under Switzerland’s network of double taxation treaties.

- Capital gains tax is typically not applied to corporate entities but may be imposed on real estate sales.

- Value added tax (VAT) is set at a standard rate of 8.1%, with reduced rates available for specific goods and services.

Investment Incentives

Switzerland provides various incentives to attract foreign capital, including tax holidays and reductions in certain cantons. R&D tax credits and innovation grants are available for technology focused companies. Additionally, bilateral trade agreements facilitate business expansion into European and global markets.

VI. Key Investment Considerations

While Switzerland offers many advantages for foreign investors, certain challenges should be considered. The country has high labor and operational costs, with salaries and living expenses among the highest in the world. The financial services sector is subject to strict compliance and anti-money laundering (AML) regulations, requiring businesses to meet rigorous reporting standards. Additionally, immigration and work permit regulations can impact the ability to hire non-EU employees, requiring additional administrative procedures.

Despite these challenges, Switzerland remains one of the most attractive investment destinations in the world. With proper structuring and planning, foreign investors can navigate these complexities and benefit from Switzerland’s stable economy, strong legal protections, and pro-business policies.

VII. Conclusion

Taken together, Switzerland offers attractive openings for well‑structured investments when investors align with local compliance requirements and leverage available incentives. With prudent structuring, effective tax rates and regulatory friction can be kept competitive, allowing foreign entrants to capture long‑term growth.

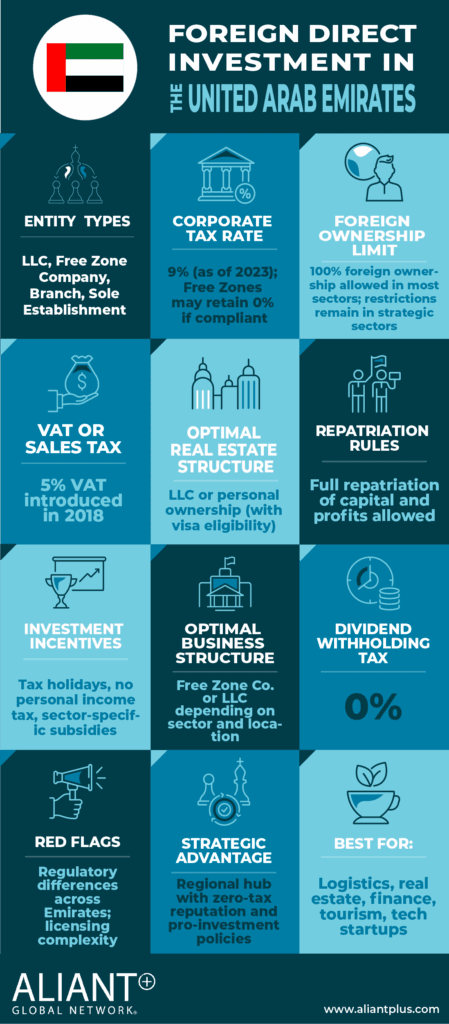

Chapter 18 – Foreign Direct Investment in the United Arab Emirates

I. Country Snapshot

II. Introduction

The United Arab Emirates (UAE) has positioned itself as a global economic hub, shifting its focus from outbound investments to fostering an investment friendly domestic environment. As part of Vision 2030, the country is prioritizing sustainable economic growth, diversification, and self- reliance, resulting in a steady increase in foreign direct investment (FDI).

With world class infrastructure, specialized free zones, and a rapidly growing domestic market, the UAE has become an attractive destination for international businesses and institutional investors. The government has significantly expanded foreign ownership opportunities, allowing 100% foreign ownership in most sectors, with exceptions for strategic industries such as oil and gas, defense, and telecommunications.

To maximize investment benefits, foreign investors should carefully consider corporate structures, tax regulations, and compliance requirements. This document provides an overview of the key aspects of investing in the UAE, including business formation, legal protections, and tax considerations.

III. Ownership Structures

Foreign investors can establish a business in the UAE through three primary jurisdictions: mainland, free zones, and offshore entities. Each jurisdiction operates under specific regulations, allowing businesses to align their operations with their investment goals and industry requirements.

Mainland Businesses

Mainland companies allow 100% foreign ownership in most sectors, including manufacturing, technology, and healthcare. However, certain industries, such as oil and gas, defense, and telecommunications, require UAE national ownership. Mainland businesses benefit from unrestricted access to the UAE market and can engage in government contracts, making them ideal for companies seeking broad operational flexibility.

Free Zone Entities

Free zones offer 100% foreign ownership, along with tax advantages and simplified regulatory processes. With over 40 free zones across the UAE, investors can establish sole proprietorships, limited liability companies, or branches of foreign entities. Some of the most recognized free zones include the Dubai International Financial Centre (DIFC) and Abu Dhabi Global Market (ADGM), which operate under common law principles, ensuring internationally recognized regulatory frameworks.

These zones cater to specific industries, providing specialized facilities and streamlined business registration processes, making them attractive for multinational corporations, startups, and high growth enterprises.

Offshore Companies

Offshore jurisdictions such as Jebel Ali Offshore Authority and RAK International Corporate Centre (RAK ICC) provide 100% foreign ownership for asset holding, international trade, and corporate structuring purposes. Offshore companies cannot conduct business within the UAE mainland and must adhere to specific regulations governing their operational scope and financial reporting requirements.

IV. Legal Protections and Dispute Resolution

The UAE has established a strong legal framework to protect investor rights, ensuring transparency and efficient dispute resolution mechanisms.

For disputes involving mainland businesses, the UAE’s civil and commercial courts offer a structured litigation process with clear appeal mechanisms. In contrast, free zones such as DIFC and ADGM have their own specialized courts operating under common law principles, making them the preferred choice for international investors due to their predictability and efficiency.

Arbitration is also widely used for commercial disputes, with institutions like the Dubai International Arbitration Centre (DIAC) providing neutral and enforceable resolutions under the New York Convention. These alternative dispute resolution mechanisms help foreign investors navigate potential legal complexities efficiently.

V. Suggested Structures for Real Estate and Business Investments

Real Estate Investments

- Optimal Structure: Holding real estate through an offshore entity such as an ADGM Offshore, JAFZA Offshore, or RAK ICC company.

- Why: Offshore entities provide asset protection, privacy, and tax efficiency. These structures are designed for long term asset management, allowing investors to consolidate ownership under a single entity while benefiting from regulatory flexibility.

- Bonus: Certain free zones offer tax neutral investment opportunities, ensuring efficient wealth structuring and regulatory compliance for institutional and individual investors. These entities also allow real estate holdings across multiple emirates, providing a unified and streamlined approach to asset management.

Business Investments

- Optimal Structure: An ADGM Offshore Company for businesses without a physical office, or a DIFC Holding Company for those requiring an operational presence.

- Why: These structures allow investors to consolidate holdings under a single legal entity, providing flexibility in structuring ownership and simplifying management. Free zones enable 100% foreign ownership and offer efficient regulatory processes, making them highly suitable for international investors.

- Bonus: These structures enjoy tax advantages, including potential exemptions from corporate tax and customs duties, subject to compliance with free zone regulations. Additionally, Special Purpose Vehicles (SPVs) within UAE free zones can be used for specific investment projects, offering further structuring flexibility.

VI. Simplified Tax Overview

The UAE provides a highly competitive tax environment, with corporate tax exemptions for free zone entities and low tax rates for mainland businesses.

- Corporate tax is set at 9% for mainland businesses on taxable income exceeding AED 375,000. Free zone companies may qualify for corporate tax exemptions if they comply with specific regulatory requirements.

- Value added tax (VAT) applies at a standard rate of 5% to most goods and services, though certain sectors such as healthcare and education benefit from exemptions.

- The UAE does not impose personal income tax, making it an attractive destination for high net worth individuals and global executives.

- Free zone entities are exempt from import and export duties, making them cost efficient for international trade and logistics businesses.

Investment Incentives

The UAE offers a range of investment incentives, including:

- Tax exemptions for free zone businesses meeting specific

- Customs duty waivers for companies operating in designated economic

- Residency visas for investors and company owners, facilitating long term business

VII. Key Investment Considerations

Foreign investors should carefully assess legal, regulatory, and operational factors before entering the UAE market.

Certain industries, including banking, financial services, and energy, require special licensing and additional regulatory compliance. Investors establishing businesses in the UAE may qualify for

long term residency visas, facilitating ease of business operations and relocation. As part of Vision 2030, the UAE government is actively encouraging investment in technology, renewable energy, and advanced manufacturing, providing potential investment opportunities.

VIII. Conclusion

Taken together, United Arab Emirates offers attractive openings for well‑structured investments when investors align with local compliance requirements and leverage available incentives. With prudent structuring, effective tax rates and regulatory friction can be kept competitive, allowing foreign entrants to capture long‑term growth.