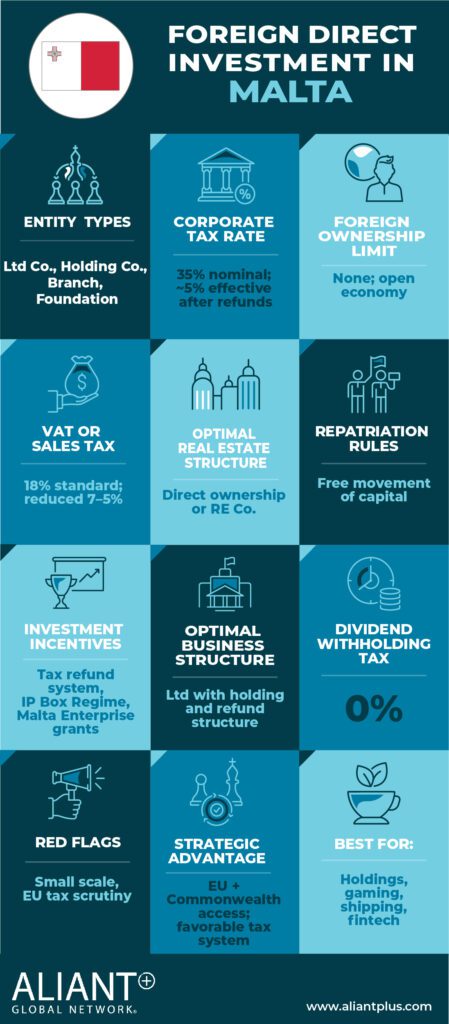

Chapter 10 – Foreign Direct Investment in Malta

I. Country Snapshot

II. Introduction

Malta has become an increasingly attractive destination for foreign direct investment (FDI), particularly in industries such as gaming, fintech, and financial services. The country’s competitive corporate tax system, strategic location in Europe, and stable regulatory framework make it a favorable jurisdiction for international businesses. Additionally, Malta offers a high quality of life, with English as an official language, a Mediterranean climate, and a well-developed infrastructure that supports international business operations.

The Maltese legal system ensures a business friendly environment, providing strong investor protections and compliance with European Union (EU) regulations. Foreign investors are generally treated equally under Maltese law, with multiple corporate structures available depending on investment objectives, liability protection requirements, and tax planning considerations.

Understanding investment structures, tax efficiency strategies, and regulatory compliance is essential for foreign investors considering entry into the Maltese market.

III. Ownership Structures

Foreign investors in Malta can establish their business through various corporate and legal entities, each offering different levels of liability protection, taxation, and compliance requirements.

Limited Liability Companies

A limited liability company (LLC) is the most commonly used business structure in Malta and can be registered as either a private or public company. A private company must restrict share transfers, limit the number of shareholders to fifty, and prohibit public share offerings. A public company, on the other hand, can issue shares to the public and is subject to stricter regulatory requirements, including the publication of a prospectus when issuing shares or debentures.

A limited liability company is constituted under the Companies Act once a memorandum of association is executed and registered. Foreign investors may own 100% of the shares in a Maltese company, and there are no restrictions on the repatriation of profits.

Partnerships

Maltese law provides for two types of partnerships: general partnerships and limited partnerships. In a general partnership, all partners have unlimited liability, whereas in a limited partnership, general partners bear full liability while limited partners’ liability is restricted to their capital contributions. Limited partnerships may also be established with variable share capital, subject to obligations under the Companies Act. This structure is useful for investors requiring flexible ownership and profit distribution options.

Direct Investment and Asset Ownership

Foreign investors may acquire real estate or equity in Maltese businesses without forming a local company. The tax treatment of direct investment mirrors that of domestic investors, with capital gains taxed only upon disposal of assets. Malta does not impose a wealth tax, ensuring an attractive fiscal environment for long term investors.

IV. Suggested Structures for Real Estate and Business Investments

Real Estate Investments

- Optimal Structure: A limited liability company (LLC) holding the real estate

- Why: Holding real estate through an LLC provides limited liability protection, reduces personal risk exposure, and allows for tax advantages, including deductions on property related expenses. This structure also simplifies ownership transfers, easing inheritance and succession planning.

- Bonus: Certain real estate transactions outside Malta may qualify for reduced tax rates, and investors can benefit from double taxation relief on foreign tax paid.

Business Investments

- Optimal Structure: A limited liability company (LLC).

- Why: An LLC is the optimal structure for business investments due to its tax benefits, ease of operation, and strong legal Shareholders enjoy lower tax rates on trading profits, and Malta’s corporate framework allows for tax refunds upon dividend distributions, making it an attractive jurisdiction for multinational businesses.

- Bonus: Foreign investors should consider structuring their businesses within Malta’s tax framework to maximize eligibility for investment incentives and ensure compliance with EU financial regulations.

V. Simplified Tax Overview

Malta operates a highly competitive and transparent tax regime, supported by a full imputation system and tax refunds for shareholders of Maltese companies. The tax system is fully compliant with EU and OECD standards, making Malta a reputable jurisdiction for global businesses.

- Corporate tax is set at 35%, but effective tax rates can be significantly lower due to refund mechanisms available to shareholders.

- Dividend taxation is mitigated by Malta’s tax refund system, allowing for reduced tax

burdens on distributed dividends.

- Capital gains tax does not exist as a separate tax; instead, gains are taxed as part of ordinary income upon disposal of assets.

- Withholding tax does not apply to outbound payments of interest, dividends, or royalties to non-residents.

- The participation exemption allows capital gains and dividends derived from qualifying foreign participations to be exempt from taxation.

- Malta has over seventy double taxation agreements, ensuring that foreign investors can minimize tax exposure on international operations.

Investment Incentives

Malta offers a range of financial incentives for foreign investors, including:

- Tax benefits under the Patent Box Regime for intellectual property

- Research and development (R&D) tax credits to encourage

- Tax relief and investment grants for businesses operating in Malta’s priority

VI. Key Investment Considerations

Foreign investors should consider the specific legal and regulatory aspects of operating in Malta. Certain industries, such as financial services, gaming, and telecommunications, require additional licensing and compliance with local regulatory authorities.

Malta’s tax system adheres to EU and OECD regulations, ensuring credibility and security for investors. However, businesses must remain compliant with corporate governance and reporting requirements to maintain eligibility for tax benefits. Additionally, foreign executives and investors may apply for residency and work permits under Malta’s various investment visa programs, offering long term business and lifestyle advantages.

VII. Conclusion

Taken together, Malta offers attractive openings for well‑structured investments when investors align with local compliance requirements and leverage available incentives. With prudent structuring, effective tax rates and regulatory friction can be kept competitive, allowing foreign entrants to capture long‑term growth.

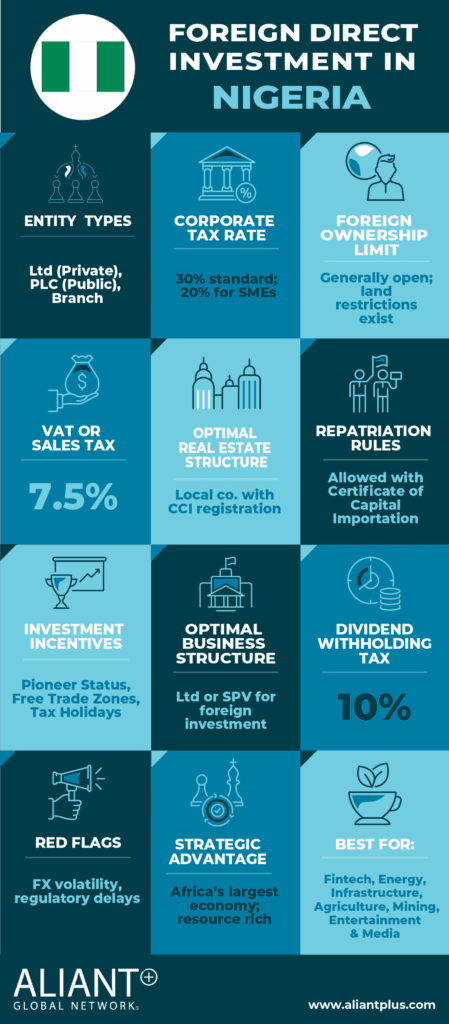

Chapter 11 – Foreign Direct Investment in Nigeria

I. Country Snapshot

II. Introduction

Nigeria stands as one of Africa’s most prominent destinations for foreign direct investment (FDI), fueled by its population of over 220 million, abundant natural resources, and expanding consumer base. With a nominal GDP exceeding $500 billion and its status as the largest economy in sub Saharan Africa, Nigeria presents significant opportunities for international investors across sectors ranging from energy and infrastructure to fintech, agriculture, and real estate.

The Nigerian government maintains a liberal investment regime, offering full foreign ownership in most sectors and legal protections under the Nigerian Investment Promotion Commission (NIPC) Act. The country also benefits from its strategic position in West Africa, providing access to regional markets through the Economic Community of West African States (ECOWAS) and the African Continental Free Trade Area (AfCFTA).

While regulatory complexity, infrastructure challenges, and currency volatility remain notable risks, Nigeria’s investment framework is maturing. Investors who plan carefully and align with the right structures and incentives can unlock long term value in a rapidly evolving market.

III. Ownership Structures

Foreign investors can establish a presence in Nigeria through various legal entities, including limited liability companies, partnerships, and branch offices. Among these, the limited liability company (LLC) is the most common and preferred structure for foreign investment.

The LLC offers limited liability to shareholders and full legal recognition under Nigerian corporate law. Foreign investors can own 100% of the shares in a Nigerian LLC, and the minimum share capital requirement for foreign participation is ₦100 million (approximately $62,500). This threshold enables eligibility for regulatory benefits such as capital repatriation, tax incentives, and expatriate quotas.

Companies must be registered with the Corporate Affairs Commission (CAC), and foreign shareholding must be recorded with the Central Bank of Nigeria (CBN) through the issuance of a Certificate of Capital Importation (CCI)—a key document that guarantees access to repatriation of profits and dividends. Investors may also establish operations in Nigeria through joint ventures, public companies (for large scale capital raising), or by acquiring existing Nigerian businesses.

IV. Suggested Structures for Real Estate and Business Investments

Real Estate Investments

- Optimal Structure: A limited liability company registered with the Corporate Affairs

- Why: An LLC provides foreign investors with legal certainty, limited liability, and eligibility for profit repatriation through the issuance of a It also allows flexibility in structuring real estate development projects or property management ventures.

- Bonus: Investors targeting commercial or residential developments may qualify for sector specific incentives, including tax holidays and duty waivers. While there are no federal restrictions on foreign ownership of land, land tenure is governed at the state level, and long term leases (up to 99 years) are the standard form of holding real estate in Nigeria.

Business Investments

- Optimal Structure: A limited liability company with a minimum share capital of ₦100 million.

- Why: This structure aligns with regulatory thresholds for foreign investment recognition and eligibility for benefits under the NIPC It enables full control over operations and access to corporate tax incentives, pioneer status, and repatriation privileges.

- Bonus: Companies investing in priority sectors such as agriculture, manufacturing, renewable energy, and infrastructure may be granted pioneer status, providing a corporate tax holiday for up to five years. Export oriented businesses may also benefit from duty exemptions and access to special economic zones.

V. Simplified Tax Overview

Nigeria’s tax regime is evolving toward greater transparency and efficiency, with reforms introduced to streamline compliance and broaden the tax base. Key corporate taxes include:

- Corporate Income Tax (CIT): 30% for large companies (turnover above ₦100 million), 20% for medium sized companies (₦25 million to ₦100 million), and 0% for small businesses (under ₦25 million).

- Withholding Tax on Dividends, Interest, and Royalties: 10%, reduced to 7.5% under certain double taxation treaties.

- Value Added Tax (VAT): 5% on most goods and services.

- Capital Gains Tax: 10% on the disposal of chargeable

- Education Tax: 5% of assessable profits.

- Technology Levy: May apply to digital and telecom companies, depending on turnover and regulatory classification.

Nigeria has signed double taxation agreements (DTAs) with several countries, including the UK, France, Canada, and South Africa, reducing tax burdens on cross border transactions and improving investment predictability.

VI. Capital Importation and Repatriation

Foreign investors are guaranteed the right to repatriate profits, dividends, and capital under the Foreign Exchange (Monitoring and Miscellaneous Provisions) Act, provided the investment is registered and a Certificate of Capital Importation (CCI) is obtained through an authorized dealer (usually a Nigerian bank). The CCI serves as formal proof of investment and ensures that funds may be legally repatriated through the official foreign exchange market.

In addition to profit repatriation, foreign owned businesses may apply for expatriate quotas to secure work permits for foreign staff. Investors are advised to manage foreign exchange risk, as currency volatility and liquidity challenges can affect the timing and value of repatriated funds.

VII. Free Trade Zones and Incentives

Nigeria offers a variety of incentives through its special economic zones, including Free Trade Zones (FTZs), Export Processing Zones (EPZs), and Oil and Gas Free Zones. Companies operating within these zones enjoy substantial tax and regulatory benefits:

- Full exemption from all federal, state, and local government taxes, levies, and

- Duty free import of capital goods, raw materials, and

- Repatriation of capital, profits, and dividends without

- Simplified customs and immigration

Additionally, export focused businesses outside FTZs may qualify for the Export Expansion Grant (EEG) scheme and duty drawback programs.

VIII. Investment Protection and Dispute Resolution

Nigeria’s Constitution and the Nigerian Investment Promotion Commission Act provide legal protection against expropriation, except in cases of national interest, and even then, only with prompt and adequate compensation.

Nigeria is a signatory to the New York Convention and the International Centre for Settlement of Investment Disputes (ICSID) Convention, making international arbitration a viable and enforceable dispute resolution mechanism. Arbitration clauses are widely used in commercial contracts, and Nigerian courts generally uphold arbitral awards in line with global best practices.

The country’s legal system is based on English common law, and judgments from foreign courts may be enforceable in Nigeria under reciprocal enforcement arrangements.

IX. Conclusion

Taken together, Nigeria offers attractive openings for well‑structured investments when investors align with local compliance requirements and leverage available incentives. With prudent structuring, effective tax rates and regulatory friction can be kept competitive, allowing foreign entrants to capture long‑term growth.

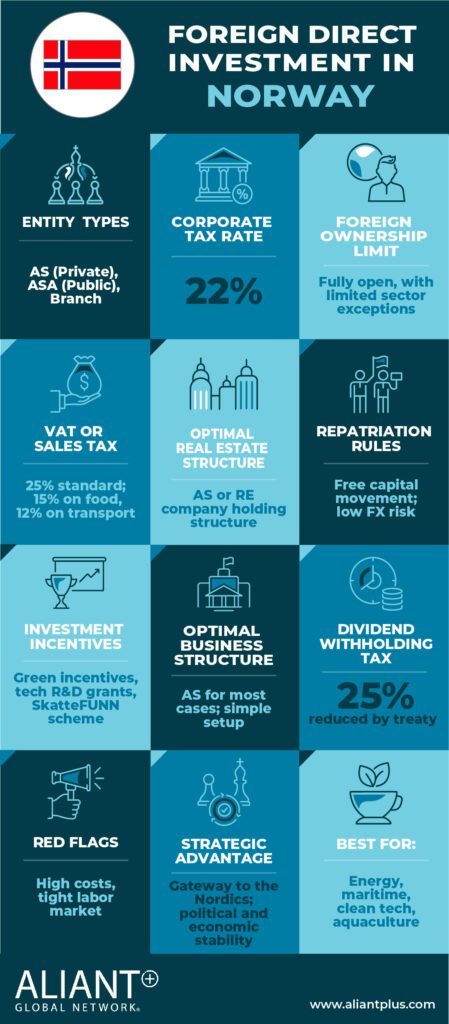

Chapter 12 – Foreign Direct Investment in Norway

I. Country Snapshot

II. Introduction

Norway offers one of the most transparent and stable environments for foreign direct investment in Europe. Ranked consistently high on global indexes for legal integrity, business efficiency, and regulatory clarity, it provides an investor friendly climate that combines Nordic pragmatism with European Economic Area (EEA) access. While not a member of the European Union, Norway participates fully in the EU internal market through its EEA agreement making it an ideal launch point for investors seeking exposure to Europe without the bureaucratic friction sometimes seen in larger EU economies.

Foreign investors face no significant restrictions on ownership of Norwegian assets, and capital may flow freely in and out of the country. That said, the tax and regulatory frameworks surrounding both real estate and corporate activity require careful attention. Choosing the right structure is not just about compliance—it’s about aligning liability exposure, optimizing tax outcomes, and positioning the investment for long term scalability.

This paper outlines the key considerations for foreign investors in Norway, including recommended structures for both real estate and business activities, an overview of the tax regime, and a strategic snapshot of how to operate efficiently in this highly regulated but welcoming jurisdiction.

III. Ownership Structures

Foreign investors in Norway may structure their investment through a variety of legal entities. The most commonly used include the Norwegian private limited company (AS), the Norwegian public limited company (ASA), and branches of foreign companies (NUF). Investors based in EEA jurisdictions may also benefit from structuring through holding companies that take advantage of participation exemptions and tax treaty benefits.

Direct Ownership

Foreign individuals may directly acquire real estate or business assets in Norway. While this approach is straightforward, it comes with notable drawbacks: full personal liability, limited estate planning opportunities, and exposure to wealth tax. Income and capital gains from directly held assets are taxable in Norway, and investors may face additional complexity in succession planning or asset transfers.

Norwegian Private Limited Company (AS)

The AS is the most flexible and widely used structure for both real estate and active business investments. It provides limited liability for shareholders and benefits from Norway’s flat corporate income tax rate. An AS must have a minimum share capital of NOK 30000 and meet residency requirements for board composition. At least half of the board must reside within the EEA, the United Kingdom, Northern Ireland, or Switzerland. The AS structure offers legal certainty, operational flexibility, and improved perception among Norwegian banks, customers, and regulatory bodies.

Norwegian Public Limited Company (ASA)

The ASA is primarily used by larger businesses seeking to raise public capital or list on regulated markets such as Oslo Bors. It requires a minimum share capital of NOK 1000000 and is subject to stricter governance standards, including mandatory board committees and gender balance rules. While more complex to operate, the ASA structure offers visibility, scalability, and access to institutional capital—making it suitable for multinational expansion into the Nordic region.

Branch of a Foreign Company (NUF)

A foreign company may operate in Norway by registering a branch, known as a NUF. This approachavoidstheneedtocreateanewlegalentitybutdoesrequirelocalregistrationandfull tax compliance on Norway source income. The NUF is taxed on profits earned in Norway and mustmaintainlocalbooksandrecords.

While it is efficient for short term operations, it provides no liability shield between the foreign parent and the Norwegian operation, which can be a limiting factor for risk sensitive investments.

EEA – Based Holding Company

Investors from within the EEA often route Norwegian investments through an intermediate holding company based in another EEA jurisdiction. This allows for the use of the EEA participation exemption, which can eliminate or reduce withholding tax on dividends and capital gains. Even non EEA investors may adopt this strategy to access treaty benefits and mitigate exposure to wealth or repatriation taxes.

IV. Suggested Structures for Real Estate and Business Investments

Real Estate Investments

- Optimal Structure: EEA based holding company owning a Norwegian

- Why: This structure provides limited liability, supports tax efficient dividend repatriation, and offers planning advantages for inheritance or It also positions the investment to qualify for the participation exemption under EEA law.

- Bonus: Investors may avoid Norway’s wealth tax by holding real estate through corporate entities rather than personal ownership, reducing personal exposure to net asset

Business Investments

- Optimal Structure: Norwegian AS or, in certain cases, a Norwegian

- Why: The AS is the preferred vehicle for most foreign owned businesses due to its credibility, limited liability, and favorable perception by banks, authorities, and commercial partners. For low scale or temporary ventures, a NUF may be used, though with reduced flexibility and increased liability risk.

- Bonus: An AS allows for the clear separation of liabilities from the foreign parent and is often required to obtain certain licenses, open local bank accounts, or participate in Norwegian tenders and procurement processes.

V. Simplified Tax Overview

Norway’s corporate tax regime is straightforward and relatively competitive by European standards.

- Corporate Income Tax: 22% flat rate

- Withholding Tax on Dividends: 25%, reduced or eliminated under EEA rules or tax treaties

- Participation Exemption: Applies to qualifying dividends and capital gains for corporate shareholders

- Wealth Tax: Individuals are taxed on net assets exceeding NOK 1700000 (2025 threshold)

- Real Estate Tax: Applied at municipal level based on assessed property values, with deductions allowed for maintenance, depreciation, and operating expenses

Norway does not levy inheritance or gift tax, though succession planning remains important for foreign investors due to wealth tax exposure and corporate exit strategy implications.

VI. Conclusion

Taken together, Norway offers attractive openings for well‑structured investments when investors align with local compliance requirements and leverage available incentives. With prudent structuring, effective tax rates and regulatory friction can be kept competitive, allowing foreign entrants to capture long‑term growth.