Chapter 7 – Foreign Direct Investment in Hungary

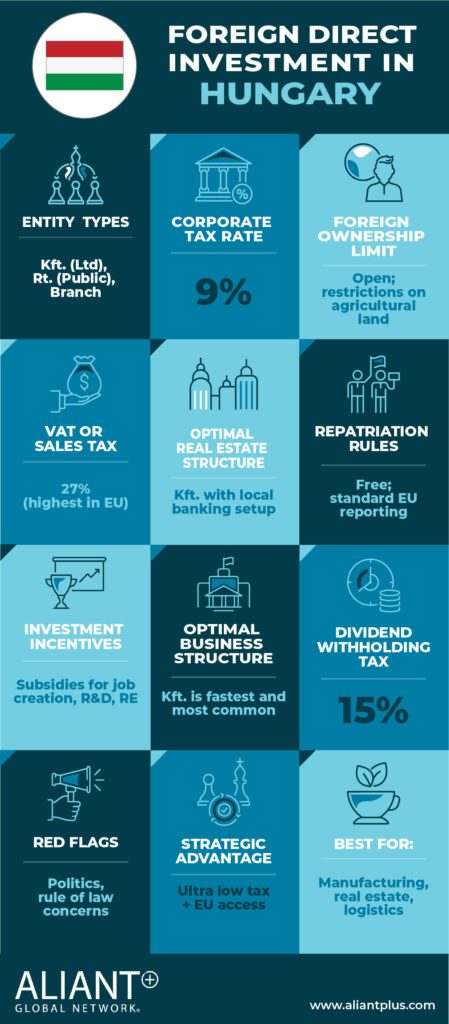

I. Country Snapshot

II. Introduction

Hungary has become a leading destination for foreign direct investment (FDI) in Central and Eastern Europe (CEE), offering a strategic location, a skilled workforce, and a business-friendly regulatory environment. The country benefits from a competitive tax system, substantial financial incentives, and its membership in the European Union (EU), which ensures seamless market access and legal stability.

The Hungarian government actively promotes foreign investment through low corporate tax rates, simplified administrative procedures, and strong investor protections. While Hungary imposes minimal restrictions on foreign ownership, certain strategic sectors require government approvals or additional licensing. Investors should carefully assess ownership structures, tax implications, and compliance requirements to ensure an optimal business strategy.

III. Ownership Structures

Foreign investors can establish a corporate presence in Hungary through several business structures, each offering different levels of liability protection, regulatory oversight, and tax benefits.

Limited Liability Company (Kft.)

A limited liability company (Korlátolt Felelősségű Társaság – Kft.) is the most commonly used business entity for small and medium sized enterprises (SMEs). It requires a minimum capital of HUF 3 million (~€7,800) and provides limited liability protection to shareholders. The Kft. is a flexible and cost effective structure, with a streamlined registration process, making it particularly attractive for privately held businesses. However, it does not allow for publicly traded shares, which may limit external financing options.

Public Limited Company (Nyrt.)

A public limited company (Nyilvánosan Működő Részvénytársaság – Nyrt.) is preferred for large scale businesses seeking access to capital markets. It requires a minimum share capital of HUF 20 million (~€52,000) and allows shares to be publicly listed and traded. This structure provides credibility and facilitates institutional investment but involves higher compliance and corporate governance requirements.

Private Limited Company by Shares (Zrt.)

A private limited company by shares (Zártkörűen Működő Részvénytársaság – Zrt.) is a hybrid between a Kft. and an Nyrt., offering limited liability while keeping shareholding private.

It requires a minimum capital of HUF 5 million (~€13,000) and does not allow public trading of shares. This structure is ideal for family owned or closely held businesses, offering ownership privacy and simplified compliance.

Branch Office

Foreign companies can establish a branch office (fióktelep) in Hungary to operate without creating a separate legal entity. The parent company retains full liability for the branch’s obligations. Registration with Hungarian authorities is required, and the branch is subject to local corporate taxation. This structure is often used by companies testing the Hungarian market before full incorporation.

IV. Investment Regulations and Restrictions

Hungary generally welcomes foreign investment, with minimal restrictions on ownership. However, certain industries require government approval to ensure national security and regulatory compliance.

Strategic Sectors with Government Oversight

Investments in defense, energy, telecommunications, and financial services require regulatory approvals from the Hungarian government. These measures are designed to safeguard critical infrastructure and maintain economic stability. Investors must conduct thorough due diligence before entering these industries.

Asset Management Foundations and Trusts

Hungary offers specialized investment structures, such as Asset Management Foundations (AMF) and Hybrid Trusts, which provide wealth protection, governance stability, and tax benefits for high net worth individuals and family businesses. These entities are particularly useful for estate planning and structured asset management.

V. Suggested Structures for Real Estate and Business Investments

Real Estate Investments

- Optimal Structure: Holding real estate through a

- Why: A Kft. provides limited liability protection while allowing investors to manage real estate assets efficiently. It ensures compliance with Hungarian real estate regulations and offers tax advantages, including deductions for property related

- Bonus: Investors acquiring large scale properties may benefit from structuring their holdings through a family trust or an Asset Management Foundation (AMF) to optimize estate planning and minimize taxation.

Business Investments

- Optimal Structure: A Kft. for SMEs and an for large corporations.

- Why: A Kft. offers a flexible and cost-effective structure for small and medium sized businesses, providing liability protection and ease of An Nyrt. is suitable for larger enterprises that require access to capital markets and institutional investors.

- Bonus: Companies looking to protect long term assets may benefit from Hybrid Trusts or Asset Management Foundations (AMF), which provide additional financial security and governance stability.

VI. Simplified Tax Overview

Hungary operates one of the most competitive tax systems in the European Union.

- Corporate income tax (CIT) is set at 9%, the lowest in the

- Withholding tax on dividends is generally exempt for foreign shareholders, subject to Hungary’s network of double taxation treaties.

- Value added tax (VAT) applies at a standard rate of 27%, with reduced rates available for specific goods and services.

- Local business tax is levied at a maximum of 2% on gross revenue, with rates varying by

Investment Incentives

Hungary offers various financial incentives to attract foreign investors, including tax exemptions and reductions in certain industries. R&D and innovation grants support technology and manufacturing sectors, while EU funding programs facilitate investments in renewable energy, infrastructure, and research projects.

VII. Recent Developments Golden Visa Program

Hungary reintroduced its Golden Visa program in 2024, allowing foreign investors to obtain long term residency through a €250,000 investment in real estate fund certificates or a €1 million donation to public education and cultural initiatives, effective from 2025.

Global Minimum Tax Implementation (2025)

From 2025, Hungary will apply the OECD’s 15% global minimum tax to companies with annual revenues exceeding €750 million. However, Hungary’s local business tax and special deductions will continue to provide favorable tax conditions for smaller firms, ensuring that the country remains an attractive destination for foreign investment.

VIII. Conclusion

Taken together, Hungary offers attractive openings for well‑structured investments when investors align with local compliance requirements and leverage available incentives. With prudent structuring, effective tax rates and regulatory friction can be kept competitive, allowing foreign entrants to capture long‑term growth.

Chapter 8 – Foreign Direct Investment in Israel

I. Country Snapshot

II. Introduction

Israel offers a welcoming and fully open environment for foreign direct investment (FDI). As a free market economy, the country does not distinguish between local and foreign investors in terms of ownership rights, investment activities, or business operations. Investors from any jurisdiction—whether the U.S., EU, or elsewhere—receive equal treatment under Israeli law.

Foreign investors can choose from several business structures when establishing operations in Israel, depending on the nature of the investment, partnership dynamics, and legal or financial considerations. While most sectors are open without restriction, limited oversight may apply in industries related to infrastructure or defense.

This document provides an overview of investment structures, tax considerations, and strategic recommendations for foreign investors seeking to enter the Israeli market.

III. Ownership Structures

Foreign investors can establish their business presence in Israel through a range of corporate and partnership structures, each offering distinct regulatory, liability, and operational features.

Private Limited Liability Company

The private limited liability company is the most widely used business form in Israel. Investors benefit from limited liability, meaning their exposure is limited to the amount invested as share capital. There is no minimum or maximum capital requirement, and incorporation is quick and straightforward.

Shareholders hold overall authority, but management is carried out by a board of directors and appointed officers. At least one director is required, and both foreign individuals and entities can serve as shareholders or directors, subject to documentation requirements.

Companies with more than 50 shareholders must meet additional reporting obligations, including the public filing of financial statements. Information about shareholders and directors is publicly accessible via the Companies Registrar.

Publicly Held, Listed Company

A public company is established following a public offering through a prospectus and is typically used for large scale operations or capital raising efforts in real estate and technology. Publicly listed companies are regulated by the Israeli Securities Authority, and foreign investors are permitted to hold shares without limitation.

Real Estate Holding Company

This structure is primarily used when a company’s main assets are real estate holdings. The sale of shares in such companies is treated as a real estate transaction, triggering real estate capital gains tax for the seller and purchase tax for the buyer. Foreign ownership is allowed without restrictions.

General Partnership

General partnerships may be formed either formally through registration or informally through conduct. All partners in a general partnership have unlimited liability and are jointly and severally liable for the acts of other partners. This structure allows for confidentiality in terms of ownership, as internal partner agreements do not need to be made public.

Limited Partnership

A limited partnership consists of one or more general partners and an unlimited number of limited partners. Limited partners are liable only up to their capital contributions, while the general partner bears full liability. Importantly, the general partner can be a limited liability company, providing additional legal protection.

The partnership must be registered, and the partnership agreement must be filed to ensure liability protection for limited partners. This structure is commonly used in Israel by venture capital funds, real estate investment vehicles, and energy or film industry ventures.

IV. General Tax Structure

Corporate income tax in Israel is generally 25%. Dividend distributions in privately held companies are also taxed at 25%, with an increased rate of 30% for shareholders holding more than 10% of the company’s shares.

General and limited partnerships are considered transparent entities, with each partner taxed individually based on personal or corporate income tax rates. Personal income tax rates range from 20% to 47%, and high earners may be subject to an additional 3% surtax on income exceeding approximately $200,000.

Real estate holding company shareholders are subject to a 25% tax on capital gains from share sales.

Incentives may be available for companies operating in development zones or recognized as qualifying technological enterprises. These incentives may include reduced corporate tax rates, grants, and favorable loan terms. Tax rates and withholding taxes applicable to foreign investors depend on Israel’s network of over 60 double taxation treaties.

V. Suggested Structures for Business Investments

Active Business Investments

- Optimal Structure: Privately held limited liability

- Why: This structure offers shareholders both control and legal It supports operational flexibility and is well suited for mergers and acquisitions.

- Bonus: No legal restrictions apply to foreign ownership. Foreign shareholders can freely participate in ownership and management of Israeli companies.

Passive Business Investments

- Optimal Structure: Limited

- Why: A limited partnership offers liability protection for passive investors while allowing income to pass through and be taxed at the partner’s individual rate.

- Bonus: Limited partners must remain passive and may not take part in the partnership’s management to maintain limited liability This structure is often favored for private equity and venture capital activity in Israel.

VI. Conclusion

Taken together, Israel offers attractive openings for well‑structured investments when investors align with local compliance requirements and leverage available incentives. With prudent structuring, effective tax rates and regulatory friction can be kept competitive, allowing foreign entrants to capture long‑term growth.

Chapter 9 – Foreign Direct Investment in Italy

I. Country Snapshot

II. Introduction

Italy is one of the largest economies in the European Union and presents significant opportunities for foreign investors. With a GDP of approximately €2 trillion in 2023, it ranks as the EU’s third largest economy after Germany and France. As a global leader in manufacturing, luxury goods, and industrial production, Italy contributes around 16% of the EU’s total manufacturing output. Its strategic location, developed infrastructure, and skilled workforce make it a prime destination for foreign direct investment.

Italy provides strong legal protections for foreign investors under international agreements and national legislation. Foreign and domestic investors generally receive equal treatment, though some restrictions apply in strategic sectors such as defense, telecommunications, and energy, where government approval may be required. Additionally, non-EU investors are subject to the reciprocity principle, meaning their ability to invest in Italy depends on whether their home country grants equivalent investment rights to Italian businesses.

Careful selection of ownership structures, tax optimization, and regulatory compliance are key factors for investors entering the Italian market. This guide provides an overview of investment structures, business regulations, and tax considerations for foreign investors.

III. Ownership Structures

Foreign investors in Italy can establish a business presence through several legal entities, each offering different liability protections, tax treatments, and compliance requirements.

Limited Liability Company (S.r.l.)

A limited liability company (Società a Responsabilità Limitata – S.r.l.) is the most commonly used corporate structure, particularly for small and medium sized enterprises. It offers limited liability protection, ensuring that shareholders are only liable up to their capital contributions. The governance structure is flexible, allowing for either a sole director or a board of directors.

An S.r.l. can be established with a minimum share capital of €1 for a simplified version (S.r.l. semplificata) or €10,000 for a standard S.r.l. However, it does not allow for publicly traded shares, making it ideal for privately held businesses that do not require external financing.

Joint – Stock Company (S.p.A.)

A joint stock company (Società per Azioni – S.p.A.) is preferred for large scale investments and businesses seeking public investment. It requires a minimum share capital of €50,000 and offers limited liability protection for shareholders. This structure allows for the issuance of publicly traded shares, providing access to stock exchanges and institutional investors. However, it involves higher compliance and governance requirements compared to an S.r.l.

Partnerships

Italy recognizes two primary types of partnerships. A general partnership (Società in Nome Collettivo – S.n.c.) involves all partners having unlimited liability for business debts, making this structure suitable for businesses where partners are actively involved in management. A limited partnership (Società in Accomandita Semplice – S.a.s.) includes at least one general partner with unlimited liability and one or more limited partners with liability restricted to their capital contributions. This structure is useful for businesses requiring passive investors.

Branch and Representative Office

Foreign companies looking to operate in Italy without forming a separate legal entity can establish a branch (filiale) or a representative office (ufficio di rappresentanza). A branch functions as an extension of the foreign parent company and is subject to local taxation and regulatory requirements. A representative office, on the other hand, is limited to market research and promotional activities and cannot engage in commercial transactions.

III. Suggested Structures for Real Estate and Business Investments

Real Estate Investments

- Optimal Structure: A limited liability company (S.r.l.) holding the real estate

- Why: Holding real estate through an r.l. provides limited liability protection, reduces personal risk exposure, and allows for tax advantages, including deductions on property related expenses. This structure also simplifies ownership transfers, easing inheritance and succession planning.

- Bonus: In certain cases, foreign ownership restrictions may apply, particularly for non- EU investors acquiring property near strategic Some investors use trust arrangements or nominee ownership structures to comply with regulatory requirements.

Business Investments

- Optimal Structure: A limited liability company (S.r.l.) for small and medium sized enterprises and a joint stock company (S.p.A.) for large corporations.

- Why: An r.l. offers flexibility, limited liability, and a lower regulatory burden, making it ideal for SMEs. For larger enterprises, an S.p.A. provides access to external investment and public listing opportunities, making it suitable for businesses seeking institutional capital or expansion through public markets.

- Bonus: Foreign investors looking to optimize their investment structure should consider setting up a holding company to manage multiple subsidiaries efficiently. Italy’s extensive network of double taxation agreements allows businesses to minimize tax exposure and maximize cross border investment efficiency.

IV. Simplified Tax Overview

Italy’s corporate tax system consists of multiple layers, each affecting a company’s overall tax liability.

- Corporate Income Tax (IRES) applies at a standard rate of 24% on taxable corporate

- Regional Production Tax (IRAP) is generally 3.9%, though rates may vary depending on the region and industry sector.

- Value Added Tax (IVA) is levied at 22% for most goods and services, with lower rates applicable to specific essential items.

- Withholding Tax on Dividends is set at 26%, though reductions may apply under Italy’s double taxation treaties.

- Capital Gains Tax is typically 24% but may be reduced based on the holding period and nature of the transaction.

Investment Incentives

Italy provides a variety of tax benefits and investment incentives to attract foreign capital. The Patent Box Regime offers reduced taxation on intellectual property income. The Super and Hyper Depreciation schemes provide tax incentives for companies investing in digital transformation and Industry 4.0 technologies. Additionally, startup and R&D tax credits are available for companies engaged in research, innovation, and high-tech development.

Foreign investors should carefully assess Italy’s extensive network of over 100 double taxation agreements to minimize tax exposure and optimize investment returns.

V. Key Investment Considerations

While Italy provides a stable and business friendly investment environment, foreign investors should consider certain regulatory factors. The reciprocity principle applies to non-EU investors, meaning investment rights depend on whether the investor’s home country grants equivalent rights to Italian businesses. Some industries, such as defense, telecommunications, and energy, may require government approval for foreign investments.

Administrative procedures in Italy can be complex, requiring foreign investors to work closely with local advisors to ensure compliance with corporate, tax, and regulatory requirements.

VI. Conclusion

Taken together, Italy offers attractive openings for well‑structured investments when investors align with local compliance requirements and leverage available incentives. With prudent structuring, effective tax rates and regulatory friction can be kept competitive, allowing foreign entrants to capture long‑term growth.