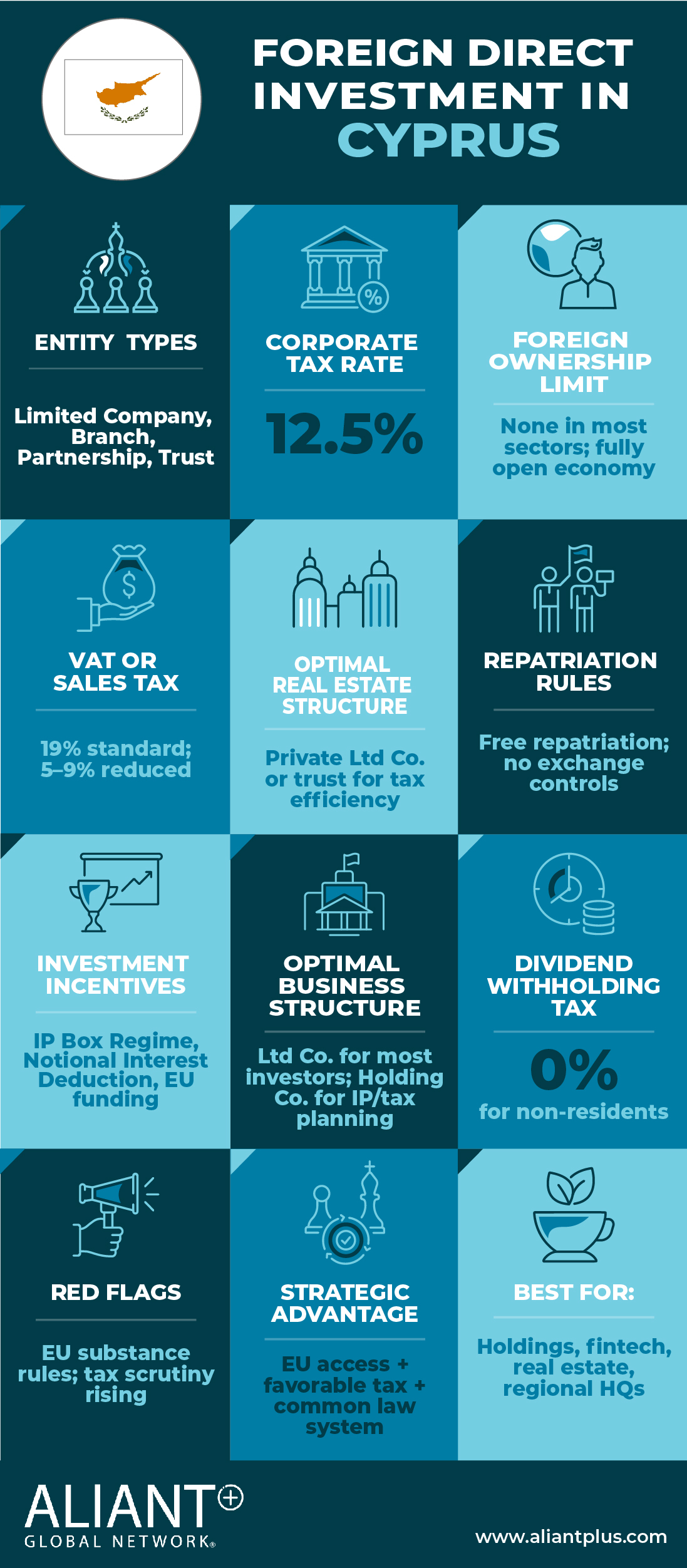

Chapter 4 – Foreign Direct Investment in Cyprus

I. Country Snapshot

II. Introduction

Cyprus has positioned itself as a leading investment destination in Europe, attracting foreign direct investment (FDI) due to its strategic location, favorable tax system, and investor friendly regulatory framework. Situated at the intersection of Europe, Asia, and Africa, the country serves as an entry point for businesses seeking access to EU and global markets.

The Cypriot legal system, based on English Common Law, provides transparency, stability, and strong protections for investors. Recent legislative reforms have streamlined business registration and licensing, making it easier for foreign businesses to establish a presence. The economy is diversified, with strong sectors including financial services, real estate, shipping, technology, and renewable energy.

Cyprus offers one of the lowest corporate tax rates in the EU and has signed over 60 double taxation treaties, ensuring tax efficiency for multinational businesses. An upcoming tax reform in 2025 is expected to modernize the country’s fiscal system, further strengthening its appeal for international investors.

III. Business and Ownership Structures

Foreign investors in Cyprus can operate through various legal entities, depending on the nature of the investment, liability considerations, and tax efficiency.

Private and Public Limited Companies

Private limited companies are the most commonly used corporate structure, particularly for small and medium sized enterprises (SMEs). They provide limited liability protection, ensuring that shareholders are only liable up to their capital contributions. These entities offer flexibility in management and ownership, making them a preferred choice for foreign investors.

Public limited companies, in contrast, are designed for large scale businesses and publicly traded enterprises. They allow companies to raise capital through public markets but require greater regulatory compliance and disclosure.

Partnerships

Cyprus recognizes general and limited partnerships, which are commonly used for joint ventures, professional services, and investment projects. General partners bear unlimited liability, whereas limited partners are only liable up to their capital contributions. Partnerships offer flexibility in governance and taxation, making them attractive for investors in finance, consulting, and real estate.

International Business Companies (IBCs)

IBCs are widely used for holding companies, international trade, and intellectual property management. They benefit from low taxation, no withholding tax on dividends, and a favorable IP Box regime, which allows for significant tax reductions on profits derived from intellectual property assets.

Investment Funds and Asset Holding Structures

Cyprus has developed a robust investment fund framework, making it an ideal jurisdiction for private equity funds, hedge funds, and asset management vehicles. The Alternative Investment Funds (AIFs) regime provides a structured environment for institutional and private investors looking to establish regulated investment entities.

IV. Key Sectors for Foreign Investment Real Estate and Hospitality

The real estate sector in Cyprus is a major driver of FDI, particularly in luxury residential,

commercial, and tourism related developments. Investment hubs such as Limassol, Larnaca, and Paphos continue to experience strong demand from both local and international buyers. Incentives, including residency programs and tax exemptions, encourage investment in large scale developments.

Financial Services and Fintech

Cyprus has emerged as a leading financial center, benefiting from EU passporting rights that allow financial firms to operate seamlessly across European markets. The jurisdiction offers favorable regulatory conditions for investment firms, forex trading platforms, and fintech startups. The absence of withholding taxes on dividends, interest, and royalties makes Cyprus an attractive location for holding and investment companies.

Shipping and Maritime

As one of Europe’s major shipping hubs, Cyprus has a competitive tonnage tax system and ranks among the largest ship registries in the EU. It attracts shipowners, operators, and service providers due to its efficient regulatory framework and maritime incentives, including recent reductions in tonnage tax for environmentally sustainable vessels.

Technology and Innovation

The technology sector in Cyprus is expanding rapidly, with government backed initiatives fostering AI, fintech, and cybersecurity development. The country offers tax incentives, R&D grants, and startup funding programs aimed at attracting high tech firms. Its strategic location and EU membership make it a prime base for technology companies serving both Europe and the Middle East.

Energy and Renewable Resources

Cyprus is advancing its energy sector through offshore natural gas exploration and renewable energy projects. The government is collaborating with international energy companies to develop its Exclusive Economic Zone (EEZ), while investments in solar and wind energy align with EU green transition goals.

V. Suggested Structures for Real Estate and. Business Investments

Real Estate Investments

- Optimal Structure: A private limited company (Ltd.) holding the real estate

- Why: Holding real estate through a corporate structure provides limited liability, tax efficiency, and easier transferability of assets. Investors benefit from tax exemptions on capital gains from securities and the ability to optimize rental income taxation.

- Bonus: Establishing a holding structure with a foreign parent entity may offer additional tax efficiency and asset protection benefits. Non-EU investors may be subject to specific real estate ownership regulations, requiring approval from Cypriot

Business Investments

- Optimal Structure: A limited liability company (s.r.o.) for small and medium-sized enterprises, or a joint stock company (a.s.) for larger corporations.

- Why: An s.r.o. offers a cost effective, flexible structure for small and medium-sized businesses. A joint stock company provides access to capital markets and enhanced investment opportunities, making it ideal for larger businesses and multinational corporations.

- Bonus: Investors should consider registering their entity in a tax friendly Czech region to take advantage of regional investment incentives, which can offer lower corporate tax rates or financial support for job creation.

VI. Simplified Tax Overview

Cyprus has a competitive and transparent tax system, making it a preferred jurisdiction for corporate and investment structures.

- Corporate Tax Rate: 5%, among the lowest in the EU.

- Capital Gains Tax: No tax on profits from securities, including shares and

- Dividend Taxation: No withholding tax on dividends, interest, or royalties paid to non-

- Intellectual Property Taxation: 80% exemption on qualifying IP profits, reducing the effective tax rate to 2.5%.

- Non-Domicile Tax Status: Investors who reside in Cyprus for at least 60 days per year benefit from zero tax on global dividend and interest income.

VII. Challenges and Future Outlook

While Cyprus provides a highly favorable investment environment, investors should be mindful of bureaucratic delays in regulatory approvals and geopolitical factors influencing financial markets. The government continues to implement reforms to streamline business processes, and the country’s expected entry into the Schengen Area by 2025 is anticipated to enhance economic integration and investor confidence.

The long-term outlook for FDI in Cyprus remains strong, supported by tax reforms, infrastructure development, and enhanced financial regulations. With a stable economic environment, strategic location, and investor friendly policies, Cyprus will continue to attract foreign investment across diverse industries.

VIII. Conclusion

Taken together, Cyprus offers attractive openings for well‑structured investments when investors align with local compliance requirements and leverage available incentives. With prudent structuring, effective tax rates and regulatory friction can be kept competitive, allowing foreign entrants to capture long‑term growth.

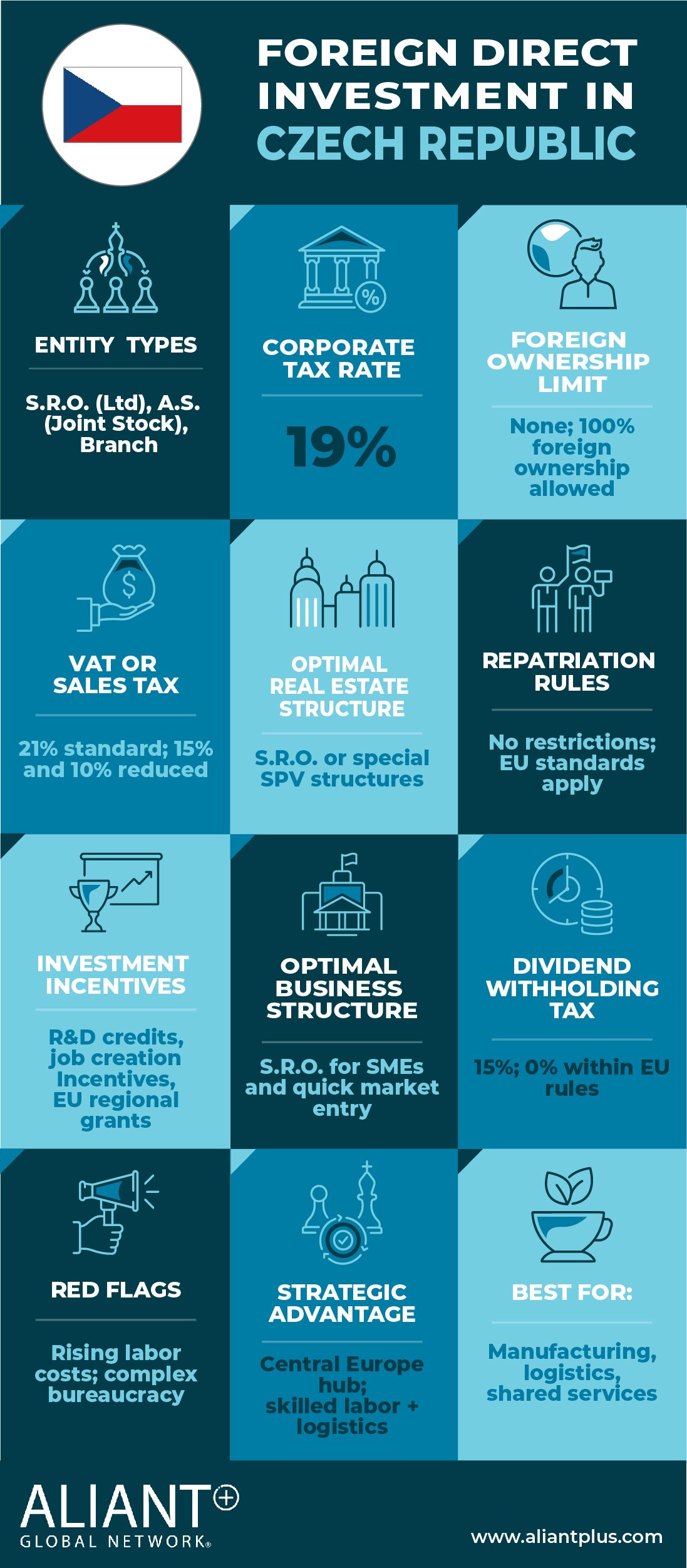

Chapter 5 – Foreign Direct Investment in the Czech Republic

I. Country Snapshot

II. Introduction

The Czech Republic is an attractive destination for foreign direct investment (FDI) due to its strategic location in Central Europe, stable legal framework, and EU membership. As part of the European Union (EU), the country provides investors with access to the EU single market, a competitive tax environment, and strong legal protections.

The Czech Republic ensures equal treatment for both foreign and domestic investors, with only minor restrictions in certain strategic sectors. Additionally, the country’s friendly business environment and highly skilled workforce contribute to its reputation as a key investment hub in Europe.

Investors considering the Czech Republic should carefully evaluate ownership structures, tax implications, and regulatory requirements to optimize their investment strategy. This guide provides an overview of business formation, legal frameworks, and tax considerations for foreign investors.

III. Ownership Structures

Foreign investors can establish a corporate presence in the Czech Republic through several legal entities, each offering different liability protections, regulatory requirements, and investment flexibility.

Limited Liability Company (s.r.o.)

A limited liability company (Společnost s ručením omezeným – s.r.o.) is the most commonly used business structure in the Czech Republic. It requires a minimum capital of CZK 1 and provides limited liability protection, ensuring that shareholders are only responsible for their capital contributions. The governance structure is straightforward, making it ideal for small and medium sized enterprises (SMEs). However, an s.r.o. does not allow for publicly traded shares, which may limit external capital raising opportunities.

Joint – Stock Company (a.s.)

A joint stock company (Akciová společnost – a.s.) is preferred for larger businesses and investors requiring access to capital markets. It requires a minimum share capital of CZK 2 million (approximately USD 84,000) and allows for public or private share issuance. Shareholders are not personally liable for company debts, and the structure facilitates access to external investment. However, it involves higher regulatory and compliance requirements compared to an s.r.o.

Partnerships

The Czech Republic recognizes two main types of partnerships. A general partnership (Veřejná obchodní společnost – v.o.s.) involves all partners having unlimited liability for the company’s obligations. A limited partnership (Komanditní společnost – k.s.) requires at least one general partner with unlimited liability, while limited partners’ liability is restricted to their capital contributions. These structures are less common for foreign investors due to higher liability risks but may be suitable for businesses built on personal relationships and trust.

Branch Office

Foreign companies can establish a branch office (odštěpný závod) to operate in the Czech Republic without forming a separate legal entity. The parent company retains full liability for the branch’s obligations, and the branch must be registered in the Czech Commercial Register. While subject to Czech corporate taxation, a branch office allows businesses to test the Czech market before full incorporation.

IV. Investment Regulations and Restrictions

Foreign investment in the Czech Republic is largely unrestricted, except in specific sectors where government approval is required to safeguard national security and critical infrastructure.

Foreign Investment Screening Act

The Foreign Investment Screening Act (Act No. 34/2021 Coll.) imposes stricter regulations on non-EU investors making significant acquisitions in sensitive industries. Investments require government approval if they involve acquiring at least 10% of voting rights in a business, gaining access to critical infrastructure, cybersecurity, or dual use technologies. Investments that may affect national security or public order must be approved by the Czech Ministry of Industry and Trade.

Strategic Sectors with Government Oversight

Foreign investments in defense, military industries, energy, telecommunications, public infrastructure, and cybersecurity services require government authorization. Investors in these sectors should ensure full regulatory compliance before proceeding with acquisitions or large scale investments.

V. Suggested Structures for Real Estate and Business Investments

Real Estate Investments

- Optimal Structure: A limited liability company (s.r.o.).

- Why: Holding real estate through an s.r.o. provides liability protection, simplified ownership transfer, and tax benefits. This structure also ensures compliance with landownership regulations for foreign investors.

- Bonus: In some cases, foreigners may need government approval when acquiring large land holdings or properties near strategic infrastructure. Investors should conduct due diligence before purchasing real estate in sensitive locations.

Business Investments

- Optimal Structure: A limited liability company (s.r.o.) for small and medium sized enterprises, or a joint stock company (a.s.) for larger corporations.

- Why: An s.r.o. offers a cost effective, flexible structure for small and medium sized businesses. A joint stock company provides access to capital markets and enhanced investment opportunities, making it ideal for larger businesses and multinational

- Bonus: Investors should consider registering their entity in a tax friendly Czech region to take advantage of regional investment incentives, which can offer lower corporate tax rates or financial support for job creation.

VI. Simplified Tax Overview

The Czech Republic offers a competitive corporate tax system with rates that vary depending on the business structure and industry.

- Corporate income tax is set at 21% for legal

- Personal income tax is either 15% or 23%, depending on the income

- Withholding tax on dividends is generally 15%, deducted at

- Value added tax (VAT) is applied at a standard rate of 21%, with lower rates available for essential goods and services.

Investment Incentives

The Czech government provides various incentives to attract foreign investors, including corporate income tax relief for specific industries and projects, subsidies for job creation, and research and development (R&D) grants. To access these incentives, foreign investors typically need to register a Czech entity and meet investment requirements.

VII. Key Investment Considerations

While the Czech Republic offers a stable investment environment, foreign investors should be aware of several regulatory and economic factors. The Foreign Investment Screening Act requires non-EU investors to obtain approval for acquisitions in sensitive industries. Additionally, all companies must comply with Czech financial reporting and corporate governance regulations. Some industries, such as banking, insurance, and financial services, have additional licensing requirements that must be met before operations can begin.

Investors are advised to work closely with legal and financial professionals to ensure full regulatory compliance and optimize tax efficiency.

VIII. Conclusion

Taken together, Czech Republic offers attractive openings for well‑structured investments when investors align with local compliance requirements and leverage available incentives. With prudent structuring, effective tax rates and regulatory friction can be kept competitive, allowing foreign entrants to capture long‑term growth.

Chapter 6 – Foreign Direct Investment in Greece

I. Country Snapshot

II. Introduction

Greece offers a compelling environment for foreign direct investment (FDI), strategically positioned at the crossroads of Europe, Asia, and Africa. Its geographic location, combined with a stable legal framework, EU membership, and access to regional emerging markets, makes it a prime destination for international capital. The country’s infrastructure, tourism appeal, and long-standing commercial ties further enhance its attractiveness to investors.

In recent years, Greece has implemented comprehensive economic reforms aimed at improving competitiveness, streamlining bureaucracy, and fostering a stable, transparent business climate.

These reforms have created significant opportunities in key sectors including tourism, renewable energy, infrastructure, and real estate. Coupled with favorable legal structures and a range of government incentives, Greece offers foreign investors a reliable and growth-oriented market in the European Union.

III. Legal Structures for Foreign Investment

Foreign investors may establish a business presence in Greece using various legal structures, each offering different benefits in terms of liability, governance, and regulatory requirements. The most commonly used structures are the Société Anonyme (S.A.), Limited Liability Company (LLC), and Branch Office. The choice depends on the size and nature of the business, tax planning, and the level of investor involvement.

The Société Anonyme (S.A.) is similar to a public limited company and is commonly used for large scale investments. It requires a minimum share capital of €25,000, with at least 20% paid at incorporation. Shareholders have limited liability, and governance is vested in a board of directors and shareholder meetings. This structure is subject to annual reporting and regulated under Law 4548/2018.

The Limited Liability Company (E.P.E.) is more flexible and commonly used by small and medium sized enterprises. It has no minimum capital requirement and can be managed by one or more individuals. Like the S.A., shareholders have limited liability. This structure is regulated by Law 3190/1955, as amended.

A Branch Office allows a foreign company to operate in Greece without creating a new legal entity. It is fully liable to the parent company, does not require capital, and must appoint a local representative. It is subject to Greek corporate income tax and regulatory filings similar to domestic companies.

All corporate entities in Greece are subject to Law 4706/2020, which imposes modern corporate governance standards, enhances transparency, and strengthens director accountability.

IV. Suggested Structures for Real Estate and Business Investments

Real Estate Investments

- Optimal Structure: A Société Anonyme (S.A.) or Limited Liability Company (LLC).

- Why: These corporate forms offer limited liability protection and facilitate ownership structuring for real estate development, acquisition, and leasing. They are suitable for residential, commercial, and hospitality investments, particularly in high demand areas such as Athens, Thessaloniki, and the Greek islands.

- Bonus: Real estate transactions are subject to a 3% Property Transfer Tax (PTT) or 10% VAT on new construction. Foreign investors acquiring real estate may also benefit from regional development incentives or residency programs for significant real estate

Business Investments

- Optimal Structure: An LLC for SMEs and a Société Anonyme (S.A.) for large scale or public market ventures.

- Why: The LLC provides operational flexibility and simplified governance for small to mid-size operations, while the S.A. is suitable for large corporations requiring capital raising and more formal governance frameworks

- Bonus: Investors may consider establishing a branch office as an initial market entry strategy to reduce setup costs while retaining full parent company control.

V. Sector – Specific Investment Opportunities

Greece offers robust opportunities in several key sectors. Tourism remains a dominant industry, with international interest in hotels, resorts, and leisure facilities. The government offers VAT incentives and other tax breaks to encourage development in this space.

In renewable energy, Greece has implemented aggressive reforms to promote solar, wind, and offshore energy projects. Laws 4964/2022 and 5106/2024 streamline licensing and environmental approvals, particularly for offshore wind. These laws also align with EU initiatives such as REPowerEU and RED III, reducing administrative barriers for foreign investors.

Real estate remains a reliable sector for investment, with strong demand for residential, commercial, and tourism related properties. Investors must comply with standard real estate procedures, including notarial deeds and land registry filings, and should account for local transfer taxes and VAT.

VI. Public – Private Partnerships (PPPs)

Greece’s PPP framework provides an opportunity for foreign investors to participate in infrastructure development, particularly in energy, transport, tourism, and environmental projects. Law 3389/2005 regulates PPPs, ensuring transparency, competitive bidding, and legal clarity.

In PPPs, the private partner typically provides technical and financial expertise while the public sector retains asset ownership. Successful examples include the Thessaloniki Metro and infrastructure upgrades in Crete and Nafplio. The combination of stable returns and public sector cooperation has made PPPs a favored structure among foreign investors.

VII. The Privatization Strategy of the Hellenic Growth Fund

The Hellenic Growth Fund (HGF), Greece’s public investment arm, plays a strategic role in the government’s privatization and economic development agenda. Its goal is to modernize public assets, attract foreign investment, and promote innovation and efficiency in key industries.

The privatization strategy, managed by the HGF, involves selling or leasing state owned assets in sectors such as energy, transportation, ports, and tourism. Ongoing and completed projects include the Egnatia Odos highway concession, privatizations at the Ports of Volos and Lavrio, and infrastructure development under the Port of Philippos II in Kavala.

These initiatives are intended to improve competitiveness, reduce public debt, and foster broader private sector participation. They also present unique opportunities for foreign investors seeking access to strategic infrastructure assets under favorable terms.

VIII. Conclusion

Taken together, Greece offers attractive openings for well‑structured foreign investments, providing a robust, EU-aligned legal and business environment, through flexible legal structures that grant protection to international investors. With a stable legal system, competitive tax policies and a growing focus on sustainability and innovation, Greece remains a highly attractive destination for foreign direct investment, allowing foreign entrants to capture long‑term growth.