Foreign direct investment (FDI) isn’t reserved for global conglomerates anymore. It’s the tool of choice for growth minded companies, institutional investors, entrepreneurs, and high net worth individuals seeking to build structure, scale, and security across borders. The motivations vary access to new markets, asset protection, regulatory arbitrage, tax optimization, or geographic diversification but there is a consistent theme: intelligent international structuring is no longer optional; it’s expected.

The challenge lies in execution. Every country has its own legal terrain, tax regime, banking system, and regulatory mindset. A structure that works in the U.S. might fall flat in France. A holding company that’s efficient in Cyprus may trigger penalties in China. A missed compliance requirement in Argentina could delay an entire expansion strategy. Navigating this patchwork requires more than a legal technician it requires cross border fluency, business instincts, and on the ground experience.

This white paper is a cross border investment resource for decision makers. Each chapter provides a streamlined, country specific breakdown of how foreign investors can operate effectively within the legal and tax systems of their chosen jurisdictions. This guide offers a practical, real-world roadmap for investors entering markets in Europe, the Americas, Asia, the Middle East, and Africa.

Each section follows a consistent framework, allowing for side-by-side comparisons and fast application to your own investment objectives. We examine the core structural questions: What entities are available? What’s required for ownership? How do repatriation and tax treaties apply? Where are the traps, and where are the incentives? You won’t find abstract policy summaries here. Instead, you’ll find what we believe every investor needs clarity, structure, and enough insight to know when to seek local advice.

At Aliant, we don’t aim to impress with complexity. We aim to empower through simplicity. That means translating multi-jurisdictional issues into actionable plans. It means giving you the context behind the law, the exceptions that matter, and the strategies that have actually worked.

Whether you’re building your first foreign subsidiary, acquiring real estate abroad, raising cross border capital, or preparing for a global exit, start here. Compare the options. Then call us, and let’s talk about how we make it work for you, your business, and your goals.

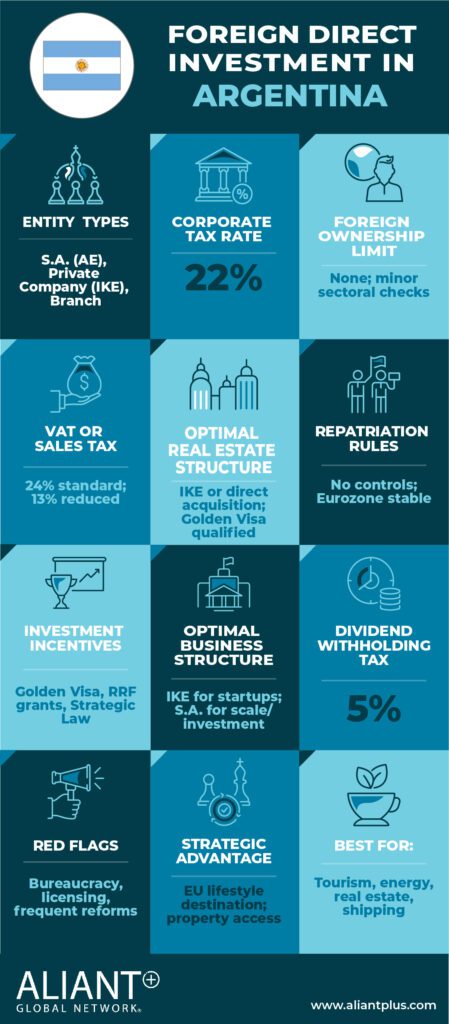

Chapter 1 – Foreign Direct Investment in Argentina

I. Country Snapshot

II. Introduction

Argentina is one of South America’s largest economies, offering foreign investors a combination of strong legal protections, diverse investment opportunities, and regulatory challenges. The country has a well-established industrial base, abundant natural resources, and a highly skilled workforce, making it an attractive destination for foreign direct investment (FDI).

The Foreign Investment Law (No. 21,382) guarantees that foreign investors receive the same legal protection as domestic investors. Additionally, Argentina has nearly 60 bilateral investment treaties and is a member of the International Centre for Settlement of Investment Disputes (ICSID). It has been an Observer of the OECD Investment Committee since 1996 and is also part of the Multilateral Investment Guarantee Agency (MIGA) and the World Bank Group, providing further investment security.

While the government actively encourages FDI, foreign exchange controls remain a challenge, particularly regarding dividend repatriation. Investors must carefully assess Argentina’s regulatory framework, tax system, and investment structures to navigate the business landscape effectively.

III. Ownership Structures

Foreign investors in Argentina can establish their business presence through several legal entities, each offering different liability protections, regulatory requirements, and tax considerations.

Corporation (Sociedad Anónima – S.A.)

A corporation is best suited for large scale businesses and joint ventures. It provides limited liability to shareholders, ensuring they are only responsible for their capital contributions. An S.A. can be structured as either a private or publicly traded company, making it ideal for capital intensive industries and multinational investments.

Limited Liability Company (Sociedad de Responsabilidad Limitada – S.R.L.)

A limited liability company is a more cost-effective and administratively simple structure, making it ideal for small and medium-sized enterprises (SMEs). Like an S.A., it provides limited liability protection to investors. However, it is generally used for single-owned businesses or companies that do not require public investment.

Branch (Sucursal)

A branch allows a foreign company to operate in Argentina without forming a separate legal entity. The parent company is fully liable for the branch’s activities, and the branch must be registered with Argentine authorities and comply with local tax and financial reporting requirements.

Land Ownership Restrictions

Foreign investment in Argentina is generally unrestricted, except for land ownership in certain provinces, where foreign ownership is capped. Investors can navigate these restrictions by establishing a trust with a local trustee, ensuring compliance while maintaining indirect ownership.

IV. The Major Investments Regime (RIGI)

To encourage large scale FDI, Argentina has implemented the Major Investments Regime (Régimen de Incentivo para-Grandes Inversiones – RIGI). This program is designed to overcome foreign exchange restrictions and enhance investment viability.

Key benefits include:

- The phased removal of foreign exchange restrictions within three years for investments exceeding USD 200 million.

- A flat corporate income tax rate of 25%, lower than the standard 25 – 35%

- Accelerated amortization of investments, reducing taxable

- Exemptions from import and export taxes, lowering operational

- Unlimited carry forward of tax losses, improving long term

- International arbitration provisions, ensuring dispute resolution outside

The RIGI program provides critical tax incentives and regulatory relief for investors in infrastructure, natural resources, and high value manufacturing.

V. Suggested Structures for Real Estate and Business Investments

Real Estate Investments

- Optimal Structure: A Sociedad Anónima (S.A.) or Sociedad de Responsabilidad Limitada (S.R.L.)

- Why: Holding real estate through an A. or S.R.L. ensures limited liability protection while maintaining compliance with foreign ownership regulations. These structures provide flexibility in managing rental income, capital gains taxation, and asset transfers.

- Bonus: In cases where foreign investors face ownership restrictions, a trust with a local trustee can serve as an alternative structure, allowing indirect investment while adhering to legal requirements.

Business Investments

- Optimal Structure: A Sociedad de Responsabilidad Limitada (S.R.L.) for SMEs, Sociedad Anónima (S.A.) for large corporations

- Why: An S.R.L. is a cost-effective structure with simplified administration, making it ideal for small and medium sized An S.A. provides the necessary flexibility for large scale investments, joint ventures, and access to public financing. Both structures offer liability protection and tax efficiency, enabling investors to operate securely in Argentina.

- Bonus: Foreign investors looking to avoid dividend repatriation restrictions should consider reinvesting profits within Argentina until foreign exchange policies stabilize, optimizing capital management and minimizing regulatory burdens.

VI. Simplified Tax Overview

Argentina has a progressive corporate tax system, with rates varying based on taxable income levels.

- Corporate Income Tax (CIT): Ranges from 25% to 35%, depending on company profits.

- Withholding Tax on Dividends: A 7% tax applies to dividends, in addition to corporate income tax.

- Value – Added Tax (VAT): Standard rate of 21%, with lower rates for specific

- Capital Gains Tax: Generally 15%, though certain exemptions and reduced rates may

Investment Incentives

Argentina offers several tax benefits and financial incentives for foreign investors:

- RIGI program benefits for investments exceeding USD 200

- Sector specific incentives for industries such as technology, renewable energy, and

- Tax credits and deductions for businesses engaged in research and development (R&D).

VII. Key Investment Considerations

While Argentina offers significant investment opportunities, foreign investors should carefully assess regulatory, financial, and economic factors.

- Foreign Exchange Controls: Strict currency restrictions impact dividend repatriation and international transactions. The RIGI program provides a phased solution for lifting these

- Regulatory Stability: While the government remains pro-business, policy changes can impact investment conditions, requiring strategic planning and adaptability.

- Legal Protections: Argentina’s bilateral investment treaties and arbitration mechanisms

VIII. Conclusion

Taken together, Argentina offers attractive openings for well‑structured investments when investors align with local compliance requirements and leverage available incentives. With prudent structuring, effective tax rates and regulatory friction can be kept competitive, allowing foreign entrants to capture long‑term growth.

Chapter 2 – Foreign Direct Investment in Austria

I. Country Snapshot

II. Introduction

Austria offers foreign investors a stable and transparent legal environment, backed by a strong economy, sound public institutions, and full integration into the European Union. The country’s legal system ensures equal treatment for domestic and foreign investors, and its open market policies, efficient bureaucracy, and comprehensive legal protections make it an attractive destination for both real estate and business investments.

Key factors to consider include the selection of the appropriate legal structure, navigating Austria’s robust regulatory framework, and understanding how tax treaties and EU law affect investment planning. This summary outlines the legal and tax considerations foreign investors should be aware of and presents recommended investment structures tailored to both real estate and business ventures in Austria.

III. Ownership Structures

Foreign investors have access to a variety of legal structures in Austria, each offering specific advantages depending on the investment goals. Common vehicles include limited liability companies (GmbH and FlexCo), stock corporations (AG), and partnerships (Kommanditgesellschaft – KG, and Offene Gesellschaft – OG). Investors can also utilize group taxation and holding company structures to manage cross-border operations efficiently.

A. GmbH and FlexCo

The GmbH is Austria’s most widely used legal entity and offers full liability protection, flexible governance, and broad market recognition. The minimum capital requirement is EUR 10,000, with EUR 5,000 to be paid in at formation. The FlexCo, a newer structure, offers even more flexible shareholding and governance features, making it ideal for modern startups and investors seeking simplified legal structures.

B. Stock Corporation (AG)

The AG requires a higher minimum capital of EUR 70,000 and is best suited for large-scale investments or companies considering going public. It offers strict governance and a robust corporate framework, suitable for institutional and international investors.

C. Partnerships (KG and OG)

A KG (limited partnership) allows for tax-transparent structuring while providing liability protection when combined with a GmbH as general partner (GmbH & Co KG). The OG (general partnership) is less commonly used for foreign investments due to unlimited liability.

D. Trusts

Trusts are generally not recognized under Austrian law and are rarely used for foreign investment purposes. They offer limited enforceability and may raise anti-abuse concerns under Austrian tax regulations.

IV. Suggested Structures for Real Estate and Business Investments

Real Estate Investments

- Optimal Structure: GmbH & Co KG (a limited partnership with a corporate general partner) or a real estate-holding GmbH

- Why: The GmbH & Co KG structure provides limited liability protection while maintaining tax transparency, allowing income, depreciation, and gains to be allocated directly to investors. This setup minimizes corporate taxation and enhances flexibility in managing distributions. The general partner GmbH shields investors from operational liabilities, and the KG can be designed to benefit from Austria’s extensive tax treaty network. If properly structured, it can also avoid real estate transfer tax under the new 75% acquisition threshold.

- Bonus: This structure is often favored by foreign family offices and private equity funds for long-term real estate holdings. While Austria does not offer REITs, regulated real estate funds (Immobilienfonds) may be considered for larger capital pooling. Succession planning and asset protection can be integrated into the GmbH & Co KG without incurring corporate-level tax.

Business Investments

- Optimal Structure: 100% subsidiary GmbH or GmbH & Co KG, potentially organized within a tax group under Austrian law

- Why: A GmbH provides full liability protection, flexible governance, and is well recognized by Austrian banks, regulators, and commercial partners. It is the most common structure for foreign business operations in Austria. For investors preferring tax transparency and direct allocation of income or losses, the GmbH & Co KG offers a useful alternative. Business income is taxed only at the partner level, not the entity level, making it well suited for long-term holdings, succession planning, or family businesses.

- Bonus: If the company is expected to scale or raise capital, consider establishing a supervisory board (Aufsichtsrat) under optional governance provisions. This step can increase investor confidence, support public funding eligibility, and align with Austrian best practices. The FlexCo is also a modern alternative for startups or ventures requiring flexible capital and shareholder structures.

V. Simplified Tax Overview

Austria imposes a 23% flat corporate income tax. Resident companies are taxed on worldwide income, and Austria allows group tax consolidation with both domestic and certain foreign subsidiaries. Tax treaties and EU directives provide relief from withholding taxes on dividends and interest, depending on the structure used.

Key highlights:

- Dividends are subject to a 25% withholding tax, which may be reduced or eliminated under double taxation treaties or EU directives.

- Interest paid to foreign non-bank entities is generally not subject to withholding tax.

- Capital gains are taxable at the corporate rate unless an exemption applies.

- Rental income and real estate gains are taxable, but depreciation and financing costs are deductible.

- Transfer pricing rules follow OECD standards, with documentation required for groups exceeding EUR 50 million in revenue.

- Controlled Foreign Corporation (CFC) rules and interest deduction limits are in place to prevent tax avoidance.

VI. Conclusion

Austria provides a highly secure and transparent legal environment for foreign investors, with strong property protections, efficient public registries, and access to the broader European market. By choosing the right legal structure—whether a GmbH, GmbH & Co KG, or FlexCo—foreign investors can achieve tax efficiency, asset protection, and regulatory compliance.

While Austria offers long-term stability and a strong rule of law framework, the legal system is highly regulated. Compliance with evolving tax and ESG standards, investment screening rules, and labor laws is essential. Working with local advisors is strongly recommended to ensure successful structuring and ongoing compliance.

Chapter 3 – Foreign Direct Investment in China

I. Country Snapshot

II. Introduction

China has become one of the world’s leading destinations for foreign direct investment (FDI), attracting multinational corporations seeking access to its vast consumer base, advanced industrial infrastructure, and skilled workforce. Since implementing economic reforms in 1978, China has transitioned from a centrally planned economy to a key global market, consistently ranking among the top three FDI recipients worldwide, according to the United Nations Conference on Trade and Development (UNCTAD).

The government continues to facilitate foreign investment through improved regulatory frameworks, trade agreements, and investment friendly policies that ensure greater market access across multiple industries. Foreign investment has played a crucial role in modernizing China’s economy, introducing advanced technologies, international management expertise, and deepening the country’s integration into global value chains.

Despite these advantages, foreign investors must navigate complex regulations, sectoral restrictions, and evolving policy changes. Understanding business structures, taxation, and compliance requirements is essential for operating successfully in China’s dynamic investment landscape.

III. Ownership Structures

Foreign investors in China can establish a business presence through various corporate structures, each offering different legal protections, investment flexibility, and regulatory considerations.

Wholly Foreign – Owned Enterprises (WFOEs)

A wholly owned foreign enterprise (WFOE) allows 100% foreign ownership, providing investors with full control over operations, management, and profit distribution. This structure ensures complete autonomy, enabling businesses to maintain proprietary technologies, independent decision making, and branding without local partnerships. The Foreign Investment Law of 2020 reinforced the legal status of WFOEs, granting them equal treatment in multiple aspects of business operations.

The establishment process involves obtaining name preapproval, defining the business scope, and securing necessary licenses from relevant authorities. The government has streamlined registration procedures in recent years, reducing processing times and administrative burdens. WFOEs are most suitable for technology companies, manufacturing firms, and service providers that require intellectual property protection and long-term market presence.

Although WFOEs offer full control and operational independence, they require higher initial investments and demand a strong understanding of the local regulatory environment. Many multinational corporations, including Apple and Tesla, have established WFOEs in China to retain control over research and development, branding, and supply chain management.

Sino – Foreign Joint Ventures (JVs)

Joint ventures (JVs) are partnerships between foreign investors and Chinese companies, allowing shared capital, management, and expertise. This structure is commonly used in industries where foreign ownership restrictions still apply, such as automotive manufacturing, financial services, and certain high-tech sectors.

JVs provide foreign investors with access to an established Chinese partner’s market knowledge, regulatory expertise, and distribution channels. These collaborations have been particularly successful in the automotive sector, where global brands like Volkswagen and Toyota have leveraged JVs to expand their market presence and localize production.

The establishment process includes negotiating investment terms, drafting a joint venture contract, and obtaining approval from regulatory authorities. While JVs facilitate entry into protected industries and expedite market penetration, they also present challenges, including potential conflicts over strategic direction, profit distribution, and decision-making authority.

Representative Offices

A representative office (RO) serves as a non-commercial liaison entity for foreign companies seeking to explore the Chinese market. ROs are primarily used for market research, promotional activities, and establishing preliminary business relationships but are prohibited from engaging in direct revenue generating operations.

The process of setting up an RO involves registering with local authorities, submitting the parent company’s incorporation documents, and appointing a chief representative. Many foreign businesses use ROs as a first step before committing to a full-fledged corporate entity in China.

Cooperative Joint Ventures (CJVs)

Cooperative joint ventures (CJVs) provide a flexible investment structure where foreign and domestic partners agree to specific contractual terms regarding capital contributions, profit sharing, and management responsibilities. Unlike traditional JVs, CJVs do not require equity ownership to be strictly tied to capital contributions, making them particularly suitable for infrastructure projects, resource development, and public private partnerships.

CJVs are widely used in industries requiring large scale investments, where foreign firms provide technology and financing while Chinese partners contribute land, labor, and government support. These ventures rely heavily on strong contractual agreements and mutual trust between the partners.

IV. Investment Regulations and Restrictions

China maintains an open yet regulated investment environment, balancing market liberalization with national security considerations. The Foreign Investment Catalogue, revised in 2022, classifies industries into encouraged, restricted, and prohibited categories.

Encouraged sectors, such as renewable energy, high tech manufacturing, and healthcare, benefit from tax incentives and preferential regulatory treatment. Restricted sectors, including telecommunications and financial services, impose equity caps and joint venture requirements. Prohibited industries, such as media, national defense, and certain cultural industries, remain off limits to foreign investment.

Foreign investment screening mechanisms have been strengthened for acquisitions in critical industries to ensure compliance with national security laws and economic policies. Investors must conduct thorough due diligence before entering sectors subject to government oversight.

V. Suggested Structures for Real Estate and Business Investments

Real Estate Investments

- Optimal Structure: A limited liability company (LLC) or a holding

- Why: Holding real estate through an LLC provides limited liability protection, streamlined asset management, and optimized tax treatment. Large scale projects often involve a holding company managing multiple project specific LLCs, allowing for greater operational efficiency.

- Bonus: Investors should consider the impact of local taxation policies, property acquisition restrictions, and market fluctuations when structuring real estate investments. Certain cities impose higher tax rates and foreign ownership limits, necessitating careful planning to ensure compliance and profitability.

Business Investments

- Optimal Structure: A limited liability company (LLC) for general businesses, or a joint stock company for high growth enterprises.

- Why: An LLC offers limited liability and operational flexibility, making it the preferred structure for commercial ventures. For startups and businesses with high growth potential, a joint stock company provides access to capital markets and facilitates potential public listings.

- Bonus: Special Economic Zones (SEZs) and Free Trade Zones (FTZs) provide additional investment incentives, including tax reductions, streamlined customs procedures, and relaxed foreign exchange regulations. These zones are ideal for export-oriented businesses and multinational companies managing global trade operations.

VI. Simplified Tax Overview

China’s Value-Added Tax (VAT) system has four main applicable rates, depending on the type of goods or services provided:

- 13% applicable to sale and import of most goods, such as manufactured products, electronics, vehicles, steel, etc.

- 9% applicable to transportation services, construction services, basic telecommunications, utilities (e.g. water, electricity, gas), and sale of agricultural products.

- 6% applicable to modern services, including financial services, consulting, R&D, legal, accounting, advertising, IT services, and other lifestyle services.

- 0% applicable to exported goods and certain cross-border services that qualify for VAT exemption or refund (e.g. software exports, international transportation).

China operates a progressive corporate tax system with preferential policies for key industries and regions.

- Corporate Income Tax (CIT) is set at 25%, with a reduced 15% rate available for qualified high-tech enterprises.

- Withholding Tax applies at a standard rate of 10% on dividends, interest, and royalties, subject to reductions under double taxation treaties.

Foreign invested enterprises may qualify for R&D tax incentives, government industrial grants, and reduced tax rates in designated SEZs and FTZs. Structuring investments efficiently allows businesses to optimize tax liabilities while remaining compliant with evolving regulations.

VII. Conclusion

Taken together, China offers attractive openings for well‑structured investments when investors align with local compliance requirements and leverage available incentives. With prudent structuring, effective tax rates and regulatory friction can be kept competitive, allowing foreign entrants to capture long‑term growth.